Batch Processing API

These specifications are intended for integrators.

Test Credentials

It is possible to test batch transaction processing on the TEST environment using the credentials below. For more information, please contact Merchant Support.

SEPA Transactions

SFTP Folder |

Please contact Merchant Support |

|---|---|

TEST Merchant Account ID |

0f3dfbdd-df34-454f-9f2a-6c46e43ce6af |

Username when using ReST API |

3878-MerchantTest |

Password when using ReST API |

2m125m7Z`n824V |

Credit Card Transactions

SFTP Folder |

Please contact Merchant Support |

|---|---|

TEST Merchant Account ID |

d0b01877-a4e2-4d50-9316-6190d4a008d4 |

| For security reasons, it is recommended to avoid using live Credit Card data when processing test batch files. Please always use TEST Credit Card data. |

Workflow

-

The Merchant Operator applies Pretty Good Privacy (PGP) encryption using Wirecard’s public key and uploads the encrypted request file via SFTP to the

from/newfolder (eg:from<foldername>/newfolder). -

The Batch Processing Service retrieves the request file and moves the original request file from the

newto theprocessedsubfolders if the upload was successful (eg:from<foldername>/newsubfolder to thefrom<foldername>/processedsubfolder). In case of uploading error, the request file is moved to theerrorsubfolder (eg:from<foldername>/error) -

The Batch Processing Service processes each transaction in the request file and generates a PGP encrypted response file using the Merchant’s Public Key.

-

When processing was successful, the encrypted response file is deposited in the

to<foldername>/newfolder on the SFTP server. In case processing failed due to a corrupted request file, the request file is stored into folderto<foldername>/error. -

The merchant operator retrieves the encrypted response file and decrypts it using their private key.

SFTP for Batch Processing

SFTP (Secure File Transfer Protocol) is used to securely transfer files between the merchant and the Batch Processing Service.

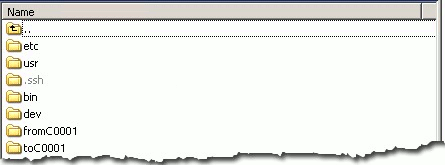

Server Directory Structure

Once logged onto the SFTP server, the merchant or partner is

automatically connected by its customer or partner number (e.g. C0001)

to the file repository, set up by Wirecard. In the root window of the

remote SFTP server site (Wirecard server) the following subdirectories

are available:

The folders from<foldername> (eg: fromC0001 or fromP0001) and

to<foldername> (eg: toC0001 or toP0001) are important for the batch

processing. They are used for upload (from<foldername>) and download

(to<foldername>) files by the merchant.

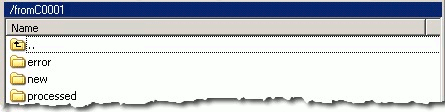

Folder from<foldername> contains the following three subfolder.

-

errorThe folder to where the request file is moved by the batch server in case an upload problem occurred. -

newThe folder where the Merchant uploads his (encrypted) request files. -

processedThe folder to where the correctly processed request files are moved by the batch service.

Folder to<foldername> contains the same named subfolders used for

-

errorThe folder where the batch processing service stores the request file in case of the request file was corrupted. -

newThe folder where the batch processing service deposits the encrypted response file. -

processedThe folder where the Merchant stores the response file after it is picked up.

The response file contains success and failed transactions.

Upload/Download

Upload Request Files

-

Login to SFTP server.

-

Open folder

from<foldername> -

Copy your batch files to the subfolder

new.

Download Response Files

-

Login to SFTP server.

-

Open the folder

to<foldername> -

Retrieve the response files from the subfolder

newand save them to your local machine. -

Move the response files from subfolder

newto subfolderprocessed, in order to keep track of your already retrieved files.

| Wirecard stores the old copies of your processed batch files on the Wirecard file server for up to 3 months. After that time period they will be deleted automatically. It is at your discretion to use this file repository. |

Processing Time

Processing of batch files begins at 8:00 am CET. Each customer’s file will be picked up and processed individually. Processing time may vary depending on the number of customers using this service.

The response file will be available in the subfolder

to<foldername>/new for pick up as soon as the request file has been

fully processed.

URL and Credentials

The URL and credentials for the SFTP Server must be provided prior to production integration. Please contact Merchant Support if you did not receive your credentials.

Files

Specifications

Request and response files must meet the following criteria:

-

Encrypted with PGP (mandatory for files including Credit Card transactions).

-

Formatted as

.csv. -

Use comma (

,) as separator.If a field value contains a comma, you need to wrap the whole field value in double quotation marks (e.g.: value1,“value,2”,value3,”value,4”). -

Linefeed:

LF(Unix format) must be used as separator for the different transactions. -

Include header columns for each field.

-

Encoded in UTF-8.

-

The different parameters must be defined in the order given in the table Batch Processing SEPA.

Here is an excerpt of a csv example to illustrate the use of a comma in a field value.

merchant_account_id,request_id,payment_method_id,transaction_type,parent_transaction_id,requested_amount,requested_amount_currency,account_number,iban,bic,token_id,card_type,expiration_month,expiration_year,first_name,last_name,order_number,order_detail (1)

cad16b4a-abf2-450d-bcb8-1725a4cef443,f749b836-69df-44f2-94a4-76b0c05a6986,creditcard,authorization,,795.02,USD,,,,4127352795354678,visa,12,2020,Paul,Peterson,order-1234,"Optionally, you selected express delivery." (1)| 1 | The field value for order_detail is enclosed in double quotation marks because it contains a comma. |

Look at our full Sample to see a complete Batch Processing csv file.

Request

Batch processing has been designed to accept transactions for several payment methods. Field requirements vary by different payment methods.

The Credit Card Fields table describes the fields that must be provided for Credit Card transaction requests.

-

The fields must be defined in the

.csvfile in the order given in the following table to allow correct processing. -

CSV format requires that each field must be specified. Empty fields (optional fields or fields not used by Credit Card) have to be defined as empty values separated by commas:

,,.

…3.33,EUR,4012000300001003,…

| Batch processing for Credit Card does not support submitting the CVV/CVC. |

+ To process Credit Card transactions via batch, it is recommended to first submit an online authorization transaction via API and follow-up with a capture transaction via batch. A capture must be submitted with a parent-Transaction ID referring to a successful authorization transaction.

+ Please refer to Credit Card for more information. The names used in the batch service may differ from the field names given in the API documentation. For details see the Batch API Field Name Mapping table.

Batch processing has been designed to accept transactions for several payment methods. Field requirements vary by different payment methods.

The Batch API SEPA Fields Table describes the fields that must be provided for SEPA transaction requests.

-

The fields must be defined in the

.csvfile in the order given in the following table to allow correct processing. -

CSV format requires that each field must be specified. Empty fields (optional fields or fields not used by SEPA) have to be defined as empty values separated by commas:

,,.

…121.22,EUR,,DE42512308000000060004,…

Please refer to SEPA DD and SEPA CT for more information. The names used in the batch service may differ from the field names given in the API documentation. For details see the Batch API Field Name Mapping table.

Request files must be given a unique batch ID using the following format:

requestbatchid.timestamp.request.csv.pgp

batchsample001.201201011801.*request*.csv.pgp

-

Where timestamp is in the format of

YYYYMMDDhhmmand in UTC timezone. -

The request batch ID will be included in the response filename and within the response file content.

-

PGP encryption is optional.

If the file is encrypted, the extension .pgp must be added to the file

name!

|

Response

Response files will be named after the request file including the request batch ID, timestamp and customer number:

requestbatchid.timestamp.<foldername>.response.csv.pgp

-

Extension

.pgpwill only be added if PGP encryption was requested. -

<foldername>is the merchants' number (SFTP User), eg:C0001

-

Request file:

batchsample001.201201011801.request.csv.pgp -

Corresponding response file:

batchsample001.201201011801.C0001.response.csv.pgp

Fields

Credit Card Request

| Field | Cardinality | Datatype | Size | Description |

|---|---|---|---|---|

merchant_account_id |

M |

Alphanumeric |

36 |

Account ID of the merchant. |

request_id |

M |

Alphanumeric |

150 |

Unique request ID for each Transaction (= Merchant Transaction ID). |

payment_method_id |

M |

Alphanumeric |

15 |

Payment method. Only SEPA DD, SEPA CT and Credit Card are allowed. |

transaction_type |

M |

Alphanumeric |

30 |

Transaction type (direct relationship to payment method). |

parent_transaction_id |

O |

Alphanumeric |

36 |

Transaction ID of authorization or parent transaction, if either transaction is available and should be referred to. |

requested_amount |

O |

Numeric |

15 |

Amount in decimal number. Max length = total number of digits. The number of digits after the decimal point depends on the currency. Example: 100.000 INR (Indian Rupee) but 100.00 EUR |

requested_amount_currency |

O |

Alphanumeric |

3 |

Currency. |

account_number |

O |

Alphanumeric |

36 |

This is the card account number of the end consumer. It is mandatory if |

iban |

Empty |

Alphanumeric |

0 |

"Provide empty value" for this field by using the construct |

bic |

Empty |

Alphanumeric |

0 |

"Provide empty value" for this field by using the construct |

token_id |

O |

Alphanumeric |

36 |

This is the token corresponding to |

card_type |

O |

See Card Types defined in API |

15 |

This is the consumer’s card type. |

expiration_month |

O |

Numeric |

2 |

This is the expiration month of the consumer’s credit card. |

expiration_year |

O |

Numeric |

2 |

This is the expiration year of the consumer’s credit card. |

first_name |

O |

Alphanumeric |

32 |

First name of consumer. |

last_name |

O |

Alphanumeric |

32 |

Last name of consumer. |

O |

Alphanumeric |

64 |

E-mail of consumer. |

|

gender |

O |

Alphanumeric |

1 |

Gender of consumer.

|

date_of_birth |

O |

YYYY-MM-DD |

10 |

Consumer’s date of birth |

phone |

O |

Alphanumeric |

32 |

Consumer’s phone number |

street1 |

O |

Alphanumeric |

70 |

Street information part 1 of consumer. This field is optional, but mandatory if |

street2 |

O |

Alphanumeric |

128 |

Street information part 2 |

city |

O |

Alphanumeric |

32 |

City of consumer This field is optional, but mandatory if |

state |

O |

Alphanumeric |

32 |

State of consumer |

country |

O |

Alphanumeric |

3 |

Country of consumer. This field is optional, but mandatory if |

postal_code |

O |

Alphanumeric |

16 |

Postal code of consumer |

entry_mode |

O |

Alphanumeric |

- |

This is information about the channel used for this transaction. Can be one of the following: |

ip_address |

O |

Alphanumeric |

15 |

IP address |

order_number |

O |

Alphanumeric |

64 |

Order number |

order_detail |

O |

Alphanumeric |

1024 |

Order detail |

descriptor |

O |

Alphanumeric |

100 |

Description of the transaction. It identifies the transaction. |

creditor_id |

E |

Empty |

0 |

"Provide empty value" for this field by using the construct |

mandate_id |

E |

Empty |

35 |

"Provide empty value" for this field by using the construct |

mandate_signature_date |

E |

Empty |

0 |

"Provide empty value" for this field by using the construct |

due_date |

E |

Empty |

0 |

"Provide empty value" for this field by using the construct |

custom_field_name_1 |

O |

Alphanumeric |

36 |

Name of custom field 1. |

custom_field_value_1 |

O |

Alphanumeric |

256 |

Value of custom field 1. In this field the merchant can send additional information. |

custom_field_name_2 |

O |

Alphanumeric |

36 |

Name of custom field 2. |

custom_field_value_2 |

O |

Alphanumeric |

256 |

Value of custom field 2. In this field the merchant can send additional information. |

custom_field_name_3 |

O |

Alphanumeric |

36 |

Name of custom field 3. |

custom_field_value_3 |

O |

Alphanumeric |

256 |

Value of custom field 3. In this field the merchant can send additional information. |

notification_transaction_state |

O |

12 |

Transaction notification state. For datatype please refer to Transaction States. |

|

notification_url |

O |

Alphanumeric |

256 |

URL for notification |

merchant_crm_id |

O |

Alphanumeric |

64 |

CRM (Customer-Relationship-Management) ID of Merchant |

periodic_type |

O |

Alphanumeric |

11 |

This is information about the periodicity of this transaction. Can be one of the following: |

sequence_type |

E |

Empty |

10 |

"Provide empty value" for this field by using the construct |

For a sample, please look at the Request Sample for Batch Processing.

SEPA Request

| Field | Cardinality | Datatype | Size | Description |

|---|---|---|---|---|

merchant_account_id |

M |

Alphanumeric |

36 |

Account ID of the merchant. |

request_id |

M |

Alphanumeric |

150 |

Unique request ID for each Transaction (= Merchant Transaction ID). |

payment_method_id |

M |

Alphanumeric |

15 |

Payment method. Only SEPA DD, SEPA CT and Credit Card are allowed. |

transaction_type |

M |

Alphanumeric |

30 |

Transaction type (direct relationship to payment method). |

parent_transaction_id |

O |

Alphanumeric |

36 |

Transaction ID of authorization or parent transaction, if either transaction is available and should be referred to. |

requested_amount |

O |

Numeric |

15 |

Amount in decimal number. Max length = total number of digits. The number of digits after the decimal point depends on the currency. 100.000 INR (Indian Rupee) but 100.00 EUR |

requested_amount_currency |

O |

Alphanumeric |

3 |

Currency Currently only |

account_number |

E |

Empty |

0 |

"Provide empty value" for this field by using the construct |

iban |

O |

Alphanumeric |

34 |

Account holder IBAN. |

bic |

O |

Alphanumeric |

11 |

Account holder BIC (BIC may have 8 or 11 characters). |

token_id |

E |

Empty |

0 |

"Provide empty value" for this field by using the construct |

card_type |

E |

See Card Types defined in API |

0 |

"Provide empty value" for this field by using the construct |

expiration_month |

E |

Empty |

0 |

"Provide empty value" for this field by using the construct |

expiration_year |

E |

Empty |

0 |

"Provide empty value" for this field by using the construct |

first_name |

O |

Alphanumeric |

32 |

First name of consumer. |

last_name |

O |

Alphanumeric |

32 |

Last name of consumer. |

O |

Alphanumeric |

64 |

E-mail of consumer. |

|

gender |

O |

Alphanumeric |

1 |

Gender of consumer. Only |

date_of_birth |

O |

YYYY-MM-DD |

10 |

Consumer’s date of birth. |

phone |

O |

Alphanumeric |

32 |

Consumer’s phone number. |

street1 |

O |

Alphanumeric |

70 |

Street information part 1 of consumer. This field is optional, but mandatory if |

street2 |

O |

Alphanumeric |

128 |

Street information part 2. |

city |

O |

Alphanumeric |

32 |

City of consumer. This field is optional, but mandatory if |

state |

O |

Alphanumeric |

32 |

State of consumer. |

country |

O |

Alphanumeric |

3 |

Country of consumer. This field is optional, but mandatory if |

postal_code |

O |

Alphanumeric |

16 |

Postal code of consumer. |

entry_mode |

E |

Alphanumeric |

0 |

"Provide empty value" for this field by using the construct |

ip_address |

O |

Alphanumeric |

15 |

IP address. |

order_number |

O |

Alphanumeric |

64 |

Order number. |

order_detail |

O |

Alphanumeric |

1024 |

Order detail. |

descriptor |

O |

Alphanumeric |

100 |

Description of the transaction. It identifies the transaction. |

creditor_id |

O |

Alphanumeric |

35 |

Creditor ID. |

mandate_id |

O |

Alphanumeric |

35 |

Mandate ID. |

mandate_signature_date |

O |

YYYY-MM-DD |

10 |

Sign Date of Mandate. Mandate signature date is always today or in the past. |

due_date |

O |

YYYY-MM-DD |

10 |

Due Date of transaction. Due Date is always in the future. If this field is left empty, Wirecard will automatically calculate the due date. For more information about 'due date' please refer to Due Date. |

custom_field-name_1 |

O |

Alphanumeric |

36 |

Name of custom field 1. |

custom_field_value_1 |

O |

Alphanumeric |

256 |

Value of custom field 1. In this field the merchant can send additional information. |

custom_field-name_2 |

O |

Alphanumeric |

36 |

Name of custom field 2. |

custom_field_value_2 |

O |

Alphanumeric |

256 |

Value of custom field 2. In this field the merchant can send additional information. |

custom_field-name_3 |

O |

Alphanumeric |

36 |

Name of custom field 3. |

custom_field_value_3 |

O |

Alphanumeric |

256 |

Value of custom field 3. In this field the merchant can send additional information. |

notification_transaction_state |

O |

- |

12 |

Transaction notification state. For datatype please refer to Transactions States. |

notification_url |

O |

Alphanumeric |

256 |

URL for notification |

merchant_crm_id |

O |

Alphanumeric |

64 |

CRM (Customer-Relationship-Management) ID of Merchant |

periodic_type |

O |

Alphanumeric |

11 |

Periodic type - Supported for recurring Direct Debit not for Credit. Only |

sequence_type |

C |

Alphanumeric |

10 |

Sequence type, if periodic type is set to recurring. Only This field is only required, if |

For a sample, please look at the Request Sample for Batch Processing

Response

Response fields are the same for SEPA and Credit Card.

| Field | Cardinality | Datatype | Size | Description |

|---|---|---|---|---|

batch_id |

Mandatory |

Alphanumeric |

36 |

Batch internal ID for the request. |

transaction_id |

Mandatory |

Alphanumeric |

36 |

The transaction ID represents the end-to-end flow of a transaction and is used to identify transactions within the banking system. It is generated by Wirecard. |

request_id |

Mandatory |

Alphanumeric |

150 |

Unique request ID for each Transaction (= Merchant Transaction ID) |

transaction_type |

Mandatory |

30 |

Transaction type (direct relationship to payment method); ONLY pending-credit or pending-debit are allowed. Please refer to Transaction States |

|

requested_amount |

Mandatory |

Numeric |

15 |

Amount in decimal number. Max length = total number of digits. The number of digits after the decimal point depends on the currency. Example: 100.000 INR (Indian Rupee) but 100.00 EUR |

requested_amount_currency |

Mandatory |

3 |

Currency, currently only EUR allowed. Please refer to Currencies |

|

notification_transaction_state |

Mandatory |

12 |

Transaction notification state. Please refer to Transaction States |

|

transaction_state |

Mandatory |

12 |

Please refer to Transaction States |

|

token_id |

Optional |

Alphanumeric |

N/A |

empty value. |

status_code |

Mandatory |

Alphanumeric |

N/A |

See Transaction Status. If multiple codes are applicable, a pipe separated list of codes will be supplied. |

status_description |

Mandatory |

N/A |

See Transaction Status. If multiple codes are applicable, a pipe separated list of codes will be supplied. Example: "The First Name has not been provided. Please check your input and try again. |The Last Name has not been provided. Please check your input and try again." |

|

completion_time_stamp |

Mandatory |

N/A |

ISO 8601 – combined date and time in UTC. Example: "2014-06-24T09:56:50+00:00" |

|

order_number |

Optional |

Numeric |

64 |

Order number |

For a sample, please look at the Request Sample for Batch Processing

Field Name Mapping

| Name in Batch Processing manual | Name in API documentation |

|---|---|

merchant_account_id |

merchant-account-id |

request_id |

request-id |

payment_method_id |

payment-method |

transaction_type |

transaction-type |

parent_transaction_id |

parent-transaction-id |

requested_amount |

requested-amount |

requested_amount_currency |

requested-currency |

account_number |

account-number |

iban |

iban |

bic |

bic |

token_id |

token-id |

card_type |

card-type |

expiration_month |

expiry-month |

expiration_year |

expiry-year |

first_name |

first-name |

last_name |

last-name |

gender |

gender |

date_of_birth |

date-of-birth |

phone |

phone |

street1 |

street1 |

street2 |

street2 |

city |

city |

state |

state |

country |

country |

postal_code |

postal-code |

entry_mode |

entry-mode |

ip_address |

ip-address |

order_number |

order-number |

order_detail |

order-detail |

descriptor |

descriptor |

creditor_id |

creditor-id |

mandate_id |

mandate-id |

mandate_signature_date |

mandate-signature-date |

due_date |

due-date |

custom_field_name_1 |

field-name (1) |

custom_field_value_1 |

field-value (1) |

custom_field_name_2 |

field-name (2) |

custom_field_value_2 |

field-value (2) |

custom_field_name_3 |

field-name (3) |

custom_field_value_3 |

field-value (3) |

notification_url |

notification-url |

merchant_crm_id |

merchant-crm-id |

periodic_type |

periodic-type |

sequence_type |

sequence-type |

| Name in Batch Processing manual | Name in API documentation |

|---|---|

batch_id |

N/A |

transaction_id |

transaction-id |

request_id |

request-id |

transaction_type |

transaction-type |

requested_amount |

requested-amount |

requested_amount_currency |

requested-amount-currency |

token_id |

token-id |

status_code |

status-code |

status_description |

status-description |

completion_time_stamp |

completion-time-stamp |

Sample Request and Response for Batch Processing

SEPA and Credit Card

The following samples contain one SEPA DD recurring first Transaction, one SEPA CT, and one Credit Card transaction:

merchant_account_id,request_id,payment_method_id,transaction_type,parent_transaction_id,requested_amount,requested_amount_currency,account_number,iban,bic,token_id,card_type,expiration_month,expiration_year,first_name,last_name,email,gender,date_of_birth,phone,street1,street2,city,state,country,postal_code,entry_mode,ip_address,order_number,order_detail,descriptor,creditor_id,mandate_id,mandate_signature_date,due_date,custom_field_name_1,custom_field_value_1,custom_field_name_2,custom_field_value_2,custom_field_name_3,custom_field_value_3,notification_transaction_state,notification_transaction_url,merchant_crm_id,periodic_type,sequence_type

0f3dfbdd-df34-454f-9f2a-6c46e43ce6af,201801021111,sepadirectdebit,pending-debit,,4.44,EUR,,DE42512308000000060004,WIREDEMMXXX,,,,,John,Smith,johnsmith@exampleemail.com,M,,,Example Street 1,,Munich,,DE,80333,,,987654321,test detail,testdescriptor SEPADebit,DE98ZZZ09999999999,12345678,2017-12-12,,,,,,,,,,,recurring,first

0f3dfbdd-df34-454f-9f2a-6c46e43ce6af,201801024567,sepacredit,pending-credit,,5.55,EUR,,DE42512308000000060004,WIREDEMMXXX,,,,,John,Smith,johnsmith@exampleemail.com,M,,,Example Street 1,,Munich,,DE,80333,,,111444777,test detail,testdescriptor SEPACredit,,,,,,,,,,,,,,,

d0b01877-a4e2-4d50-9316-6190d4a008d4,201801020812,creditcard,capture,,3.33,EUR,4012000300001003,,,,visa,11,2019,Jane,Smith,janesmith@exampleemail.com,F,,,Example Street 2,,Munich,,DE,,,,123456789,,testdescriptorCC,,,,,,,,,,,,,,,batch_id,transaction_id,request_id,transaction_type,requested_amount,requested_amount_currency,transaction_state,token_id,status_code,status_description,completion_time_stamp,order_number

A0041984A21A11E4BF3E39F7227D0BCB,0f3dfbdd-df34-454f-9f2a-6c46e43ce6af,201801021111,pending-debit,4.44,EUR,success,,201.0000,The resource was successfully created.,2018-01-02T09:39:57+00:00,987654321

A0041984A21A11E4BF3E39F7227D0BCB,0f3dfbdd-df34-454f-9f2a-6c46e43ce6af,201801024567,pending-credit,5.55,EUR,success,,201.0000,The resource was successfully created.,2018-01-02T09:39:57+00:00,111444777

A0041984A21A11E4BF3E39F7227D0BCB,d0b01877-a4e2-4d50-9316-6190d4a008d4,201801020812,capture,3.33,EUR,success,,201.0000,The resource was successfully created.,2018-01-02T09:39:57+00:00",123456789PGP Encryption

Introduction

Pretty Good Privacy (PGP) is a data encryption and decryption computer program that provides cryptographic privacy and authentication for data communication. PGP encryption uses a serial combination of hashing, data compression, symmetric-key cryptography, and, finally, public-key cryptography; each step uses one of several supported algorithms. Each public key is bound to a user name and/or an e-mail address.

Please refer to https://www.openpgp.org/about/ for more information on PGP.

The PGP encryption and its keys apply for all Batch processes.

Samples

Linux

gpg --gen-keygpg --import batch-user.pubgpg --armour --export batch-sandbox > /root/batch-sandbox-pub-key.ascgpg -e -r "batch-user" batch-request.csvgpg -d batch-response.csv.gpgWindows

Please visit https://www.gpg4win.org/ for client and samples of PGP encryption on Windows.

Public Keys

Public Key Exchange

Since the Public Key Infrastructure (PKI) is used for all message exchanges, it is necessary that public keys are exchanged between platforms prior to integration.

Sandbox Public Key

The sandbox public key is listed below. This public key is used for encryption of the Batch Processing Service request file. You can download the Sandbox Public Key here.

-----BEGIN PGP PUBLIC KEY BLOCK-----

Version: GnuPG v2.0.14 (GNU/Linux)

mQENBFFTazIBCACsu4VCFtb1nEWmhBcG2rCjuprOqdEycm9T+lntqMKK/HmcM4NC

ElY3dEg46ltqnnlRPF+3w0rYNG+h5xwlBR1FgH9aqGQNt7vRBJjtbRmoA1z1NXXV

ztVgvjWsAinEodiueii55MwEQmNoF7v06zsbHcEGiBuuq48vyr5OKRhC0dpckx3P

EawrZ2OSpYpEtPT6hvuE4uikIMe4K/3d2ZmM8TLS8jqnNDEC2+bBWd4SKF3fbqUM

a3SfwXe1UGrfmhcIf5ETXZSfKEsAS+OzOeg2AkzFjYvEcS5dwKVCRL6hYovEWicL

akh2G6f669bywyiZslbZJg5ZHzRSYIdRxkYvABEBAAG0cXNhbmRib3gtYmF0Y2hp

bmctcHVibGljLWtleSAoU2FuZGJveCBiYXRjaGluZyBmaWxlIGVuY3J5cHRpb24g

a2V5KSA8c2FuZGJveC1iYXRjaGluZy1zdXBwb3J0QGVsYXN0aWNwYXltZW50cy5j

b20+iQE+BBMBAgAoBQJRU2syAhsDBQkSzAMABgsJCAcDAgYVCAIJCgsEFgIDAQIe

AQIXgAAKCRDY4NvfKBdE/b56B/9scSMsLEUqKxDr/BKiHtfpr9bEva0MCehVHYgJ

m3uOVPPcF6WZ8LSQa89GYDiZfs6tZpb1KWaiLnOgY0WXiTAQH9oa0zbqUHInV32y

3IZ19N1lBFoJSUztLYI0llnfMRlNFoxtBtA6aRtvXBKci9nc2UVR2I+5vqRlse34

ZGYndvJx6AFCLqgBv25PItJzBz8Hs/2vS6VQ5qWCmI70px2OSGxB7M9X995o+x/I

18RIBtnNaPQSkTvi5/ywhuSCDC11iEbOc8iLrdHRsDYaL0ouqUStIRxCh0Cx0Oy5

kd2uzM2S4mzm0zO7MoNDP2H1Hf7EaksY8uFLzwih798ted2ouQENBFFTazIBCACk

mznaDawkj/srpNbmomG0UXPJSFsZLUP/yyCKUdZCulm+uQhTEV39CTuvENhRfOrQ

C8sDqauikbumQ8rqaeADVfv43YRK2QIXO/oP8aucnE8GneJGW8YCxVVfREzNNJrM

sbQznjiagtUpnLVIFtRLNpwRNt91CzsUB7Uv3kFCj0aAWFyr+v1llNQe+NoNdpW4

qm8Gm1dpHYycImG7sRsAINdXbgSeg5XnIzqzV1vbijG12X2ATq950bPBytTNr8jD

opf+OzPH3lC5mhcX8+8cpokQqJTRKV8ZTQHtaIX7vW4AbKcG7l04SDA2uyLdm9K/

80uJvnI5RKLIGTdkG6yDABEBAAGJASUEGAECAA8FAlFTazICGwwFCRLMAwAACgkQ

2ODb3ygXRP3seQf/Rxxm+ymeXMBSgQ8Zdj7WOveqMVtPvMzbq2tXZp2UT8wO6yhB

J88FzdnPQfTOeJq46HsYpKmja0V3+gYbVXmJkLO8ZT0lYu+euhLVvTDE1RThvCuH

IjLxsTjogeuvtnDbT/s/khu032d131qGs+dHP2LRuyQxJM3Kp1AAoSf4UQzPGZiC

VfgDRrhNAyVGrl8xutoVbCOTtWJbdXbC0piqHuqnGGbshHs9sce7NI++M4K4TxdY

xiWVhF5niJ50evGyCAm47X7uJHk6/EVwSAbAlbAbhkFzweLcu+7uCrfbIln/nGfE

frjJ9jGq5CLZJjc00EtkNB65wacQHxzfq7EU2w==

=MPTt

-----END PGP PUBLIC KEY BLOCK-----Production Public Key

The production public key will be provided prior to production integration.

Merchant Public Key

The merchant is required to send their public key via email to our Merchant Support. The merchant’s public key is used for encryption of the Batch Processing Service response file.