Sofort.

REST API

Sofort is a type of Online Bank Transfer.

Countries and Currencies

Countries |

AT, BE, CH, CZ, DE, ES, IT, HU, NL, PL, SK and UK |

|---|---|

Currencies |

EUR, CHF, CZK, HUF PLN, GBP CZK and HUF are valid Sofort currencies but cannot be tested. |

Communication Formats

This table illustrates how Sofort notifications are encoded and which formats and methods can be used for requests and responses.

Requests/Responses |

Format |

Please contact Merchant Support for Format. |

|---|---|---|

Methods |

Please contact Merchant Support for Methods. |

|

IPN Encodement |

Please follow the instructions given at Instant Payment Notification to set up IPN. |

|

Transactions

Transaction Types

For transaction type details which are not given here look at Transaction Types.

| Transaction Type | Description |

|---|---|

check-signature |

Validates digital signature for a Payment Page transaction. |

get-url |

A step in a group of transactions where the provider or bank’s URL is retrieved for the Account Holder to be redirected to. |

debit |

Moves funds from the Consumer Account to the Merchant Account. |

Reference Transaction

| Additional information concerning the referenced transaction functionality can be found here: Cross-Payment-Methods Referencing |

Restrictions

|

When using Sofort some banks do not transmit consumer data (e.g.

name) to Wirecard Payment Gateway. As these fields are mandatory for a

refund (e.g. via SEPA Credit Transfer), the merchant is obliged to

provide the consumer data to guarantee a successful refund. |

Test Credentials

URLs (Endpoints) |

|

|---|---|

Merchant Account ID (MAID) |

6c0e7efd-ee58-40f7-9bbd-5e7337a052cd |

Username |

16390-testing |

Password |

3!3013=D3fD8X7 |

Secret Key |

58764ab3-5c56-450e-b747-7237a24e92a7 |

Sort Code |

Country |

Germany |

|

Please use SFRT{ISO country code}20XXX, for example SFRTDE20XXX for Germany |

all other |

|

|||

User ID |

any text, minimum 4 characters |

|||

Password |

any text, minimum 4 characters |

|||

Account Number |

select one from list provided by Sofort |

|||

TAN |

any text, minimum 4 characters |

|||

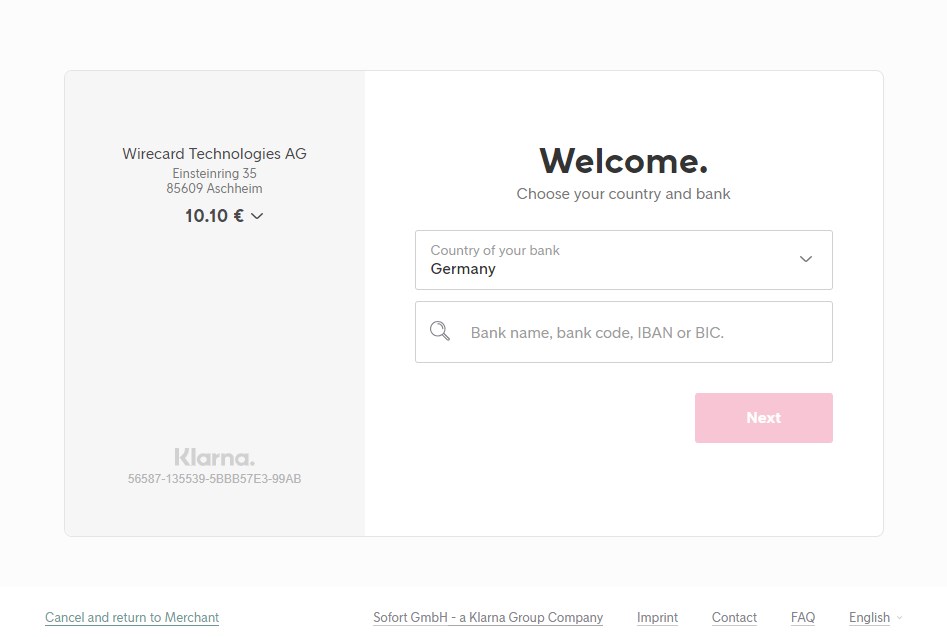

Workflow

-

Consumer chooses Sofort on the merchant’s payment page

-

Consumer is re-directed and logs in to his/her online banking account

-

Consumer confirms the payment

-

Consumer is re-directed to the Sofort confirmation page

In the case of a successful payment, the consumer is redirected back to merchant’s website and the Wirecard Payment Gateway sends the merchant a notification of the successful transaction.

If the notification is not sent, the merchant has the possibility to send a request to Retrieve Transaction by Transaction-ID or to Retrieve Transaction by Request-ID.

The response will enable the merchant to retrieve the current status of the requested transaction.

Fields

The following elements are mandatory (M), optional (O) or conditional (C) for sending request/response/notification.

| Field | Request | Response | Notification | Data Type | Size | Description |

|---|---|---|---|---|---|---|

|

M |

M |

M |

String |

36 |

Unique identifier for a merchant account. |

|

M |

M |

String |

36 |

The Transaction ID is the unique identifier for a transaction. It is generated by Wirecard. |

|

|

M |

M |

M |

String |

150 |

This is the identification number of the request. It has to be unique for each request. |

|

M |

M |

M |

String |

30 |

This is the type for a transaction. |

|

M |

M |

String |

12 |

This is the status of a transaction. |

|

|

M |

M |

dateTime |

This is the timestamp of completion of request. |

||

|

M |

M |

String |

12 |

This is the code of the status of a transaction. |

|

|

M |

M |

String |

256 |

This is the description to the status code of a transaction. |

|

|

M |

M |

String |

20 |

This field gives information if a status is a warning, an error or an information. |

|

|

M |

M |

String |

12 |

This is the status of a transaction. |

|

|

M |

M |

M |

Decimal |

18.3 |

This is the amount of the transaction. The amount of the decimal place is dependent of the currency. |

|

O |

O |

O |

String |

36 |

Transaction ID of the first transaction of a payment. |

|

O |

O |

O |

String |

32 |

This is the end-consumer’s city. |

|

O |

O |

O |

String |

3 |

This is the end-consumer’s country. |

|

O |

O |

O |

String |

16 |

This is the end-consumer’s postal code. |

|

O |

O |

O |

String |

32 |

This is the end-consumer’s state. |

|

O |

O |

O |

String |

128 |

This is the first part of the end-consumer’s street. |

|

O |

O |

O |

String |

128 |

This is the second part of the end-consumer’s street. |

|

O |

O |

O |

Date |

0 |

This is the end-consumer’s birth date. |

|

C |

C |

C |

String |

64 |

This is the end-consumer’s email address. It is mandatory if the field wallet-account-id is not sent in the initial request. |

|

O |

O |

O |

String |

27 |

This is the first name of the end-consumer. The maximum size of first-name and last-name in combination is 27 characters. |

|

O |

O |

O |

String |

1 |

This is the end-consumer’s gender. |

|

O |

O |

O |

String |

27 |

This is the last name of the end-consumer. The maximum size of first-name and last-name in combination is 27 characters. |

|

O |

O |

O |

String |

32 |

This is the phone number of the end-consumer. |

|

C |

C |

C |

String |

32 |

This is the Business Identifier Code of the bank of the end-consumer. This parameter has to be filled in case this element is sent in the request. Allowed are the following characters: ([a-zA-Z]{4}[a-zA-Z]{2}[a-zA-Z0-9]{2}([a-zA-Z0-9]{3})?) |

|

C |

C |

C |

String |

32 |

This is the Business Identifier Code of the bank of the end-consumer. This parameter has to be filled in case this element is sent in the request. Allowed are the following characters: ([a-zA-Z]{4}[a-zA-Z]{2}[a-zA-Z0-9]{2}([a-zA-Z0-9]{3})?) |

|

O |

O |

String |

50 |

The name of the bank as returned by Sofort. To enable/disable this field, contact Merchant Support. |

|

|

O |

O |

O |

String |

15 |

The global (internet) IP address of the consumers computer. |

|

M |

M |

M |

String |

64 |

This is the order number of the merchant. |

|

O |

O |

O |

String |

65535 |

This is a field for details of an order filled by the merchant. |

|

M |

M |

M |

String |

27 |

Description on the settlement of the account holder’s account about a transaction. The following characters are allowed: umlaut, - '0-9','a-z','A-Z',' ' , '+',',','-','.' |

|

O |

O |

O |

String |

256 |

The URL to be used for the Instant Payment Notification. It overwrites the notification URL that is set up in the merchant configuration. |

|

O |

O |

O |

String |

36 |

This is the name of the custom field. |

|

O |

O |

O |

String |

256 |

This is the content of the custom field. In this field the merchant can send additional information. |

|

M |

M |

M |

String |

15 |

This is the name of the payment method that that is chosen from the end-consumer. Value Sofort. should be used. |

|

M |

String |

The API id is always returned in the notification. |

|||

|

O |

O |

O |

String |

2 |

The instrument country is extracted from the IBAN. |

|

O |

O |

O |

String |

256 |

The URL to which the consumer will be redirected after he has fulfilled his payment. This is normally a page on the merchant’s website. |

|

M |

M |

M |

String |

256 |

The URL to which the consumer will be re-directed after he has cancelled a payment. This is normally a page on the merchant’s Website. |

|

M |

M |

M |

String |

256 |

The URL to which the consumer will be re-directed after a successful payment. This is normally a success confirmation page on the merchant’s website. |

|

M |

String |

The Signature info, consisting of SignedInfo, SignatureValue and KeyInfo. |

Status Codes

| Status Code | Provider Code Description |

|---|---|

200.0000 |

Transaction ok - consumer protection applied. |

201.0000 |

Transaction OK |

201.1126 |

Transaction OK |

500.1052 |

A Provider is unavailable. |

500.1088 |

The requested function is not supported. |

500.1094 |

The Merchant Account is not properly configured for processing. Please contact technical support. |

500.1099 |

Transaction processing refused. Please contact technical support. |

500.1108 |

Transaction processing aborted. |

500.1109 |

Malformed/Invalid Parameter. Please check your input. |

500.1127 |

Failed confirmation received from the third party. |

501.999 |

The acquirer returned an unknown response. Please contact technical support. |

500.2100 |

Request processing failure. |

500.2380 |

Account blacklist check failure. |

500.2417 |

Unknown bank account |

Additional Features

Configure the Transaction Time Frame

|

The Look of Sofort. on the Merchant’s Website

Sofort requires merchants to follow certain guidelines when offering the payment method on their website.

Sofort recommends to place a link instead of the badge. By using the link, Sofort. will host the badge and update it automatically on the merchant’s web site.

Sofort provides the badges in two formats and allows individual sizes:

-

The format is either svg or png. It is the merchant’s decision which format to use by setting the correct file extension.

-

Using png determines the size directly according to the format. Leaving the size blank, the badge will be delivered with the standard width of 100 pixel.

-

Sofort suggests a width between 100 and 300 pixel. To change the width from 100 pixel to e.g. 300 pixel, add "?width=300" directly after the format.

The following is the general form of the link to the badge:

https://cdn.klarna.com/1.0/shared/image/generic/badge/xx_XX/name_of_the_badge/standard/pink.[format][size]

-

Use the Sofort badge with the svg format and the standard size:

https://cdn.klarna.com/1.0/shared/image/generic/badge/xx_XX/pay_now/standard/pink.svg

-

Display the badge with the png format and the size 300 pixel:

https://cdn.klarna.com/1.0/shared/image/generic/badge/xx_XX/pay_now/standard/pink.png?width=300

Samples

Go to Notification Examples, if you want to see corresponding notification samples.

<?xml version="1.0" encoding="utf-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>6c0e7efd-ee58-40f7-9bbd-5e7337a052cd</merchant-account-id>

<request-id>${unique for each request}</request-id>

<transaction-type>get-url</transaction-type>

<requested-amount currency="EUR">1.01</requested-amount>

<payment-methods>

<payment-method name="sofortbanking" />

</payment-methods>

<descriptor>FANZEE XRZ-1282</descriptor>

<success-redirect-url>http://127.0.0.1:8080/success</success-redirect-url>

<cancel-redirect-url>http://127.0.0.1:8080/cancel</cancel-redirect-url>

</payment><?xml version="1.0" encoding="utf-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>6c0e7efd-ee58-40f7-9bbd-5e7337a052cd</merchant-account-id>

<transaction-id>a712ab53-2eaf-46ed-bc4f-8da660425b20</transaction-id>

<request-id>e77075b2-edd1-459e-acd8-c5014fe2348d</request-id>

<transaction-type>get-url</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-04-13T10:27:48.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information" />

</statuses>

<requested-amount currency="EUR">1.01</requested-amount>

<descriptor>FANZEE XRZ-1282</descriptor>

<payment-methods>

<payment-method url="https://www.sofort.com/payment/go/fef1b8eea14b54c102440984b49a502115db9523" name="sofortbanking" />

</payment-methods>

<cancel-redirect-url>http://127.0.0.1:8080/cancel</cancel-redirect-url>

<success-redirect-url>http://127.0.0.1:8080/success</success-redirect-url>

</payment><?xml version="1.0" encoding="utf-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>6c0e7efd-ee58-40f7-9bbd-5e7337a052cd</merchant-account-id>

<request-id>${unique for each request}</request-id>

<transaction-type>get-url</transaction-type>

<requested-amount currency="EUR">0</requested-amount>

<payment-methods>

<payment-method name="sofortbanking" />

</payment-methods>

<descriptor>Free Gift</descriptor>

<success-redirect-url>http://127.0.0.1:8080/success</success-redirect-url>

<cancel-redirect-url>http://127.0.0.1:8080/cancel</cancel-redirect-url>

</payment><?xml version="1.0" encoding="utf-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>6c0e7efd-ee58-40f7-9bbd-5e7337a052cd</merchant-account-id>

<transaction-id>b53705c1-852d-49a3-bf94-98a5cc02fb3d</transaction-id>

<request-id>3a75519f-bb4e-41a0-824e-a37929c23c20</request-id>

<transaction-type>get-url</transaction-type>

<transaction-state>failed</transaction-state>

<completion-time-stamp>2018-04-13T10:33:40.000Z</completion-time-stamp>

<statuses>

<status code="400.1013" description="The Requested Amount is below the minimum required for this Merchant Account. Please check your input and try again." severity="error" />

</statuses>

<requested-amount currency="EUR">0</requested-amount>

<descriptor>Free Gift</descriptor>

<payment-methods>

<payment-method name="sofortbanking" />

</payment-methods>

<cancel-redirect-url>http://127.0.0.1:8080/cancel</cancel-redirect-url>

<success-redirect-url>http://127.0.0.1:8080/success</success-redirect-url>

</payment>Wirecard Payment Page v2

Wirecard Payment Page v1 ![]() is no longer supported. We recommend using Wirecard Payment Page v2 integration instead. If you have questions about your existing Wirecard Payment Page v1 integration, consult our REST API integration guide.

is no longer supported. We recommend using Wirecard Payment Page v2 integration instead. If you have questions about your existing Wirecard Payment Page v1 integration, consult our REST API integration guide.

General Information

This is a reference page for Sofort. Here you find all the information necessary for integrating this payment method into your Hosted and Embedded Payment Page.

|

Are you unfamiliar with Wirecard Payment Page v2 (WPP v2)?

Visit one of the integration guides

(Hosted,

Embedded) for a quick explanation and

a step-by-step guide before continuing.

|

All WPP v2 integrations share a common process flow for creating payments.

Below, you find example requests for the available transaction type debit, including field lists with short descriptions.

These requests are designed for the testing environment and do not use real information.

| For production, you need to use production credentials. For details contact merchant support. |

All given requests return successful responses.

For more details on the redirect-url, see the

Configuring Redirects and IPNs for WPP v2

section.

For response verification examples, see the WPP v2 Security section.

About Sofort.

Sofort GmbH is a payment service provider which has been part of the Klarna Group since 2014. Sofort (also known as Pay now with Klarna) allows consumers to make online purchases using their online banking details. Merchants get a real-time transfer confirmation, and can dispatch their goods straight away.

Test Credentials

Test credentials for the transaction type debit.

URI (Endpoint) |

|

|---|---|

Merchant Account ID (MAID) |

f19d17a2-01ae-11e2-9085-005056a96a54 |

Username |

70000-APITEST-AP |

Password |

qD2wzQ_hrc!8 |

Secret Key (used for response verification) |

ad39d9d9-2712-4abd-9016-cdeb60dc3c8f |

Bank (Sort Code) |

Demo Bank (00000) |

|---|---|

User ID/password/TAN/other |

Arbitrary (4 characters minimum) |

| On Sofort testing environment, use the sort code 00000 or the name "Demo Bank" when prompted. For other credentials (User ID, password, TAN) any number/text will do as long as it is at least 4 characters long. |

Transaction Type debit

A debit transaction charges the specified amount from the account holder’s bank account and marks it for immediate transfer.

For a successful debit transaction:

-

Create a payment session (initial request).

-

Redirect the consumer to the payment page (initial response URL).

-

Highly recommended: Parse and process the payment response.

We provide ready-made JSON examples for each step of this process. You find them below.

Endpoint for Sofort transactions.

The initial request creates the payment session. If it is successful, you receive a URL as a response which redirects to the payment form.

Authorization |

Basic NzAwMDAtQVBJVEVTVC1BUDpxRDJ3elFfaHJjITg= |

|---|---|

Content-Type |

application/json |

For a full list of optional fields you can use, see the REST API Sofort specification.

For a full structure of a request (optional fields included), see the JSON/NVP Field Reference section at the bottom.

{

"payment": {

"merchant-account-id": {

"value":"f19d17a2-01ae-11e2-9085-005056a96a54"

},

"request-id":"{{$guid}}",

"transaction-type": "debit",

"requested-amount": {

"value": "10.1",

"currency": "EUR"

},

"payment-methods": {

"payment-method":[

{

"name": "sofortbanking"

}

]

},

"descriptor": "test",

"success-redirect-url": "https://demoshop-test.wirecard.com/demoshop/#/success",

"fail-redirect-url": "https://demoshop-test.wirecard.com/demoshop/#/error",

"cancel-redirect-url": "https://demoshop-test.wirecard.com/demoshop/#/cancel"

}

}| Field (JSON) | Data Type | Mandatory/Optional | Size | Description | |

|---|---|---|---|---|---|

merchant-account-id |

value |

String |

Mandatory |

36 |

A unique identifier assigned to every merchant account (by Wirecard). |

request-id |

String |

Mandatory |

150 |

A unique identifier assigned to every request (by merchant). Used when

searching for or referencing it later. Allowed characters: [a-z0-9-_] |

|

transaction-type |

String |

Mandatory |

36 |

The requested transaction type. For Sofort payments, the

transaction-type must be set to |

|

requested-amount |

value |

Numeric |

Mandatory |

18 |

The full amount that is requested/contested in a transaction. 2 decimal places allowed. Use . (decimal point) as the separator. |

currency |

String |

Mandatory |

3 |

The currency of the requested/contested transaction amount. For Sofort

payments, the currency must be set to Format: 3-character abbreviation according to ISO 4217. |

|

payment-method |

name |

String |

Mandatory |

15 |

The name of the payment method used. Set this value to |

descriptor |

String |

Mandatory |

27 |

Description of the transaction for account holder’s bank statement purposes. |

|

success-redirect-url |

String |

Mandatory |

2000 |

The URL to which the consumer is redirected after a successful payment,

e.g. |

|

fail-redirect-url |

String |

Mandatory |

2000 |

The URL to which the consumer is redirected after a failed payment,

e.g. |

|

cancel-redirect-url |

String |

Mandatory |

2000 |

The URL to which the consumer is redirected after having canceled a payment,

e.g. |

|

{

"payment-redirect-url" : "https://wpp-test.wirecard.com/?wPaymentToken=f0c0e5b3-23ad-4cb4-abca-ed80a0e770e7"

}| Field (JSON) | Data Type | Description |

|---|---|---|

payment-redirect-url |

String |

The URL which redirects to the payment form. Sent as a response to the initial request. |

At this point, you need to redirect your consumer to

payment-redirect-url (or render it in an iframe depending on your

integration method).

Consumers are redirected to the payment form. There they enter their data and submit the form to confirm the payment. A payment can be:

-

successful (

transaction-state: success), -

failed (

transaction-state: failed), -

canceled. The consumer canceled the payment before/after submission (

transaction-state: failed).

The transaction result is the value of transaction-state in the

payment response. More details (including the status code) can also be

found in the payment response in the statuses object. Canceled

payments are returned as failed, but the

status description indicates it was canceled.

In any case (unless the consumer cancels the transaction on a 3rd party provider page), a base64-encoded response containing payment information is sent to the configured redirection URL. See Configuring Redirects and IPNs for WPP v2 for more details on redirection targets after payment and transaction status notifications.

You can find a decoded payment response example below.

{

"descriptor" : "test",

"payment-methods" : {

"payment-method" : [ {

"name" : "sofortbanking"

} ]

},

"parent-transaction-id" : "e9a8b4ad-161b-4721-a799-e512141f1512",

"api-id" : "up3-wpp",

"transaction-id" : "974d9b1e-5381-4813-b09c-5f755da43840",

"statuses" : {

"status" : [ {

"description" : "Successful confirmation received from the bank.",

"severity" : "information",

"code" : "201.1126"

} ]

},

"account-holder" : {

"first-name" : "Max",

"last-name" : "Mustermann"

},

"request-id" : "e2234c45-84ab-44a2-b299-56cab4fcc927",

"requested-amount" : {

"value" : 10.100000,

"currency" : "EUR"

},

"transaction-state" : "success",

"success-redirect-url" : "https://demoshop-test.wirecard.com/demoshop/#/success",

"merchant-account-id" : {

"value" : "f19d17a2-01ae-11e2-9085-005056a96a54"

},

"completion-time-stamp" : "2018-04-13T10:47:10",

"cancel-redirect-url" : "https://demoshop-test.wirecard.com/demoshop/#/cancel",

"fail-redirect-url": "https://demoshop-test.wirecard.com/demoshop/#/error",

"transaction-type" : "debit"

}| Field (JSON) | Data Type | Description | |

|---|---|---|---|

descriptor |

String |

Description of the transaction for account holder’s bank statement purposes. |

|

payment-method |

name |

String |

The name of the payment method used. |

parent-transaction-id |

String |

The ID of the transaction being referenced as a parent. |

|

api-id |

String |

Identifier of the currently used API. |

|

transaction-id |

String |

A unique identifier assigned to every transaction (by Wirecard). Used when searching for or referencing to it later. |

|

status |

code |

String |

Status code of the status message. |

description |

String |

The description of the transaction status message. |

|

severity |

String |

The definition of the status message. Possible values:

|

|

account-holder |

first-name |

String |

The first name of the account holder. |

last-name |

String |

The last name of the account holder. |

|

request-id |

String |

A unique identifier assigned to every request (by merchant). Used when searching for or referencing it later. |

|

requested-amount |

currency |

String |

The currency of the requested/contested transaction amount. For

Sofort payments, the currency must be set to Format: 3-character abbreviation according to ISO 4217. |

value |

Numeric |

The full amount that is requested/contested in a transaction. |

|

transaction-state |

String |

The current transaction state. Possible values:

Typically, a transaction starts with state in-progress and finishes with state either success or failed. This information is returned in the response only. |

|

success-redirect-url |

String |

The URL to which the consumer is redirected after a successful

payment, e.g. |

|

merchant-account-id |

value |

String |

A unique identifier assigned to every merchant account (by Wirecard). |

completion-time-stamp |

YYYY-MM-DD-Thh:mm:ss |

The UTC/ISO time-stamp documents the time and date when the transaction

was executed. Format: YYYY-MM-DDThh:mm:ss (ISO). |

|

cancel-redirect-url |

String |

The URL to which the consumer is redirected after having canceled a

payment, e.g. |

|

fail-redirect-url |

String |

The URL to which the consumer is redirected after a failed payment,

e.g. |

|

transaction-type |

String |

The requested transaction type. For Sofort payments, the

transaction-type must be set to |

|

Post-Processing Operations

WPP v2 is best used to deal with one-off payments (e.g. regular, independent debit transactions) or the initial transaction in a chain of them (e.g. a first authorization in a chain of recurring transactions). However, when it comes to referencing a transaction for any kind of post-processing operation - such as a refund of one of your debit transactions - use our REST API directly.

|

A direct refund through WPP v2 is not possible for Sofort so you have to

obtain your consumer’s banking information and send the refund using

SEPA Credit Transfer. Check the REST API SEPA Credit Transfer specification for details on Sofort specific post-processing operations. |

JSON/NVP Field Reference

Here you can:

-

find the NVP equivalents for JSON fields (for migrating merchants),

-

see the structure of a full request (optional fields included).

{

"payment": {

"merchant-account-id": {

"value":"string"

},

"request-id":"string",

"transaction-type": "string",

"requested-amount": {

"value": 0,

"currency": "string"

},

"payment-methods": {

"payment-method":[

{

"name": "string"

}

]

},

"account-holder" : {

"first-name" : "string",

"last-name" : "string"

},

"descriptor": "string",

"success-redirect-url": "string",

"fail-redirect-url": "string",

"cancel-redirect-url": "string"

}

}| Field (NVP) | Field (JSON) | JSON Parent |

|---|---|---|

merchant_account_id |

value |

merchant-account-id ({ }) |

request_id |

request-id |

payment ({ }) |

transaction_type |

transaction-type |

payment ({ }) |

requested_amount |

value |

requested-amount ({ }) |

requested_amount_currency |

currency |

requested-amount ({ }) |

payment_method |

payment-method ([ ])/name |

payment-methods ({ }) |

first_name |

first-name |

account-holder ({ }) |

last_name |

last-name |

account-holder ({ }) |

descriptor |

descriptor |

payment ({ }) |

success_redirect_url |

success-redirect-url |

payment ({ }) |

fail_redirect_url |

fail-redirect-url |

payment ({ }) |

cancel_redirect_url |

cancel-redirect-url |

payment ({ }) |

{

"payment": {

"transaction-id" : "string",

"transaction-state" : "string",

"completion-time-stamp" : "2018-03-23T10:41:34",

"api-id" : "string",

"statuses" : {

"status" : [ {

"description" : "string",

"severity" : "string",

"code" : "string"

} ]

}

}

}| Field (NVP) | Field (JSON) | JSON Parent |

|---|---|---|

transaction_id |

transaction-id |

payment ({ }) |

transaction_state |

transaction-state |

payment ({ }) |

completion_time_stamp |

completion-time-stamp |

payment ({ }) |

api_id |

api-id |

payment ({ }) |

status_description_n |

status ([ {} ])/ description |

statuses ({ }) |

status_severity_n |

status ([ {} ])/ severity |

statuses ({ }) |

status_code_n |

status ([ {} ])/ code |

statuses ({ }) |