Features

Cross-Referencing

You can cross-reference transactions by:

Merchant Referencing

It is possible to enable cross payment account references for a merchant in Wirecard Payment Gateway. It means a transaction from the merchant account A can reference another one from the merchant account B if its processing user has access rights also to the merchant account A. This is a typical scenario for marketplace portals where a consumer can allow to reuse his payment instrument for the further orders without the new authentication process (so-called one-click-payment).

Merchant Setup

It is possible to reference a previous transaction using a different merchant account.

The general rule is:

-

The processing user used in the referencing transaction must have access rights to the merchant account of the referenced transaction.

-

The access rights to a particular merchant account for the given processing user must be established on the ACL level.

In order to enable the cross reference feature for a merchant account the following global merchant parameter must be set to true: global.crossreference.enabled

In order to see the cross referenced transactions in WEP, the WEP user must also be granted to access the data of the referenced merchant account. If this is not the case, the cross referenced transactions are not shown inside the payment details list. i.e. the user cannot see the transaction data of other merchants even if their transactions are referencing the transactions of the others. This is a default setup situation for a merchant WEP user.

The billing logic for the cross referenced transactions is unchanged. The cross referenced transactions are billed for the corresponding merchant account used in the payment request.

The merchant reconciliation report is unchanged as well. The cross referenced transactions are reported inside the reconciliation file for the corresponding merchant account.

Samples

|

Initial Transaction

Note that the "periodic" attribute must be selected to mark which

transaction is the first and will be referenced later.

|

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>c7f1ba89-73ce-4237-9873-64295913ce7d</merchant-account-id>

<request-id>2f3eb6ce-509c-4eb5-9f3f-527198e9ff75</request-id>

<transaction-type>get-url</transaction-type>

<payment-methods>

<payment-method name="ideal"/>

</payment-methods>

<requested-amount currency="EUR">2.31</requested-amount>

<order-description>test order</order-description>

<descriptor>customerStatement 18009998888</descriptor>

<bank-account>

<bic>INGBNL2A</bic>

</bank-account>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>19317</order-number>

<mandate>

<mandate-id>manid</mandate-id>

<signed-date>02-02-2015</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<periodic>

<periodic-type>installment</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>c7f1ba89-73ce-4237-9873-64295913ce7d</merchant-account-id>

<transaction-id>713e3527-1a4b-11e5-b3a3-0050b65c678c</transaction-id>

<request-id>2f3eb6ce-509c-4eb5-9f3f-527198e9ff75</request-id>

<transaction-type>get-url</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-06-24T10:31:58.000+02:00</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="EUR">2.31</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>19317</order-number>

<descriptor>customerStatement 18009998888</descriptor>

<payment-methods>

<payment-method url="https://idealtest.secure-ing.com/ideal/issuerSim.do?trxid=0050000101476386&ideal=prob" name="ideal"/>

</payment-methods>

<bank-account>

<bic>INGBNL2A</bic>

</bank-account>

<mandate>

<mandate-id>manid</mandate-id>

<signed-date>02-02-2015</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<periodic>

<periodic-type>installment</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>c7f1ba89-73ce-4237-9873-64295913ce7d</merchant-account-id>

<transaction-id>739faf84-1a4b-11e5-b3a3-0050b65c678c</transaction-id>

<request-id>2f3eb6ce-509c-4eb5-9f3f-527198e9ff75</request-id>

<transaction-type>debit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-06-24T10:32:00.000+02:00</completion-time-stamp>

<statuses>

<status code="201.1126" description="ideal:Successful confirmation received from the bank." severity="information"/>

</statuses>

<requested-amount currency="EUR">2.31</requested-amount>

<account-holder>

<first-name>Hr</first-name>

<last-name>E G H Küppers en/of MW M.J. Küpp</last-name>

</account-holder>

<order-number>19317</order-number>

<descriptor>customerStatement 18009998888</descriptor>

<payment-methods>

<payment-method name="ideal"/>

</payment-methods>

<mandate>

<mandate-id>manid</mandate-id>

<signed-date>0007-08-08T00:00:00.000+01:00</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<api-id>---</api-id>

<periodic>

<periodic-type>installment</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

<Signature xmlns="http://www.w3.org/2000/09/xmldsig#">

<SignedInfo>

<CanonicalizationMethod Algorithm="http://www.w3.org/TR/2001/REC-xml-c14n-20010315"/>

<SignatureMethod Algorithm="http://www.w3.org/2000/09/xmldsig#rsa-sha1"/>

<Reference URI="">

<Transforms>

<Transform Algorithm="http://www.w3.org/2000/09/xmldsig#enveloped-signature"/>

</Transforms>

<DigestMethod Algorithm="http://www.w3.org/2000/09/xmldsig#sha1"/>

<DigestValue>bZHaJgxjFpyO7VnpTwaTWa3ynM8=</DigestValue>

</Reference>

</SignedInfo>

<SignatureValue>ZWOEjEbw1k4xfW85qTWSfaXFEPL4i1QuopVjmRctiZ844DYqninTi7qO6xRM4EbC3hBi5da2/yn1

EGBO6T3Z8FrlmQtOgoIV5iGBqWqDZMF+EB7UTwMXU+VQMNCzOLFBLgDacVCMHCuEvcWVKJO5y+SD

0abg8rOX1P/oaaLmHYSsFk7TC/s0BcGl7pb3VSW3KhOAIFx2t0FEEioE2+t7GUgVNPs8FlxnWHZ2

yQIFblEEMmFD5UrAmHJ/uUj8c4qmGgQ2EcdSSvUO8gy1LZisstQrN8GhwyvaimrSv/QKwvAAwTnO

+ms/TVEGoKuaKCZzxHPGquQFQ8pG5cdG+m/JjQ==</SignatureValue>

<KeyInfo>

<X509Data>

<X509SubjectName>CN=Manoj Sahu,OU=Operations,O=Wirecard Elastic Payments,L=Toronto,ST=ON,C=CA</X509SubjectName>

<X509Certificate>MIIDcDCCAligAwIBAgIETgQWGTANBgkqhkiG9w0BAQUFADB6MQswCQYDVQQGEwJDQTELMAkGA1UE

CBMCT04xEDAOBgNVBAcTB1Rvcm9udG8xIjAgBgNVBAoTGVdpcmVjYXJkIEVsYXN0aWMgUGF5bWVu

dHMxEzARBgNVBAsTCk9wZXJhdGlvbnMxEzARBgNVBAMTCk1hbm9qIFNhaHUwHhcNMTEwNjI0MDQ0

NDA5WhcNMTQwMzIwMDQ0NDA5WjB6MQswCQYDVQQGEwJDQTELMAkGA1UECBMCT04xEDAOBgNVBAcT

B1Rvcm9udG8xIjAgBgNVBAoTGVdpcmVjYXJkIEVsYXN0aWMgUGF5bWVudHMxEzARBgNVBAsTCk9w

ZXJhdGlvbnMxEzARBgNVBAMTCk1hbm9qIFNhaHUwggEiMA0GCSqGSIb3DQEBAQUAA4IBDwAwggEK

AoIBAQCc8rTt4N5fNeVzlsRgOXKDE2YUSfJx7xXBozFZ3Vh3XQyy3IpIuEfZz7004k4HeonfTxCN

etBvJ9rgNc0Cxrk/euMj3pOUrE9WYN2eAXC0r5pUIAZhIAnSxUSaIF3JKBxf7gDAik5d8RT5HaJV

4n5cXJQ/uhAEYU3EGN/74UrD2UsOYD3VBXTJS5VgSi/c3IyLwhDbYIyU6j4fMKyHIlAMGzW7VgKD

2pqu6BRysqUVdEEAvW2OmyVqGVyPkm87EiHSMMSar3CvYYxYqBN2KBUjabkvnRWbIzyQuyUyDeUb

QmhVQKL0WlMb5ev65m2VjGyDTGL5jfB14rSXRMGzeJ+LAgMBAAEwDQYJKoZIhvcNAQEFBQADggEB

ADgkuN/e2IFy7JXdbjNJbKBd3HLvFvK87dv8qQ+HK4qfCxYXh6aYhbKHJSA6C2pbOD3HBXoyovZr

mk/KqOyUL+unVcR+APjxX4KP25sdkplgmeQ47CWxtKAHZUTtWwAVI/WhsX89SSucBfIS5TJ54e7m

02qvGoK8UA/IRbIQ6DZ9hEKV5VQKiMx3ubwwHGXfOWz2fKmeZBuTeY+HiTEH8KCHpfw2j8G+dDgU

jlp9LvjVNmJzfNBBk1Si0d/rhXmMzVSKj08tp1sPRK0/sJtJZBzQajpnsZ9NFfoJNdG13AzYwDP3

x/QspK0jYn1KZw1qz524VWoQoueR8Xj30A2jntA=</X509Certificate>

</X509Data>

</KeyInfo>

</Signature>

</payment>{

"payment" : {

"merchant-account-id" : {

"value" : "c7f1ba89-73ce-4237-9873-64295913ce7d"

},

"request-id" : "2f3eb6ce-509c-4eb5-9f3f-527198e9ff75",

"transaction-type" : "get-url",

"requested-amount" : {

"value" : 2.31,

"currency" : "EUR"

},

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"order-number" : "19317",

"descriptor" : "customerStatement 18009998888",

"payment-methods" : {

"payment-method" : [ {

"name" : "ideal"

} ]

},

"bank-account" : {

"bic" : "INGBNL2A"

},

"mandate" : {

"mandate-id" : "manid",

"signed-date" : "02-02-2015"

},

"creditor-id" : "DE98ZZZ09999999999",

"periodic" : {

"periodic-type" : "installment",

"sequence-type" : "first"

}

}

}{

"payment" : {

"merchant-account-id" : {

"value" : "c7f1ba89-73ce-4237-9873-64295913ce7d"

},

"transaction-id" : "713e3527-1a4b-11e5-b3a3-0050b65c678c",

"request-id" : "2f3eb6ce-509c-4eb5-9f3f-527198e9ff75",

"transaction-type" : "get-url",

"transaction-state" : "success",

"completion-time-stamp" : 1435134718000,

"statuses" : {

"status" : [ {

"value" : "",

"code" : "201.0000",

"description" : "The resource was successfully created.",

"severity" : "information"

} ]

},

"requested-amount" : {

"value" : 2.31,

"currency" : "EUR"

},

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"order-number" : "19317",

"descriptor" : "customerStatement 18009998888",

"payment-methods" : {

"payment-method" : [ {

"url" : "https://idealtest.secure-ing.com/ideal/issuerSim.do?trxid=0050000101476386&ideal=prob",

"name" : "ideal"

} ]

},

"bank-account" : {

"bic" : "INGBNL2A"

},

"mandate" : {

"mandate-id" : "manid",

"signed-date" : "02-02-2015"

},

"creditor-id" : "DE98ZZZ09999999999",

"periodic" : {

"periodic-type" : "installment",

"sequence-type" : "first"

}

}

}|

Recurring Transaction

This is a request for SEPA Credit where periodic type is "recurring".

This means that this is a referencing payment. Please note that the

"parent-transaction-id" is the same as the one from the response of the

"first" (parent) transaction.

|

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>e7c87536-2e7d-4cfc-abc8-9bb1d81907ca</merchant-account-id>

<request-id>3864ca4a-eaac-4a65-968c-047676fd6101</request-id>

<transaction-type>credit</transaction-type>

<requested-amount currency="EUR">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<payment-methods>

<payment-method name="sepacredit"/>

</payment-methods>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-01-05</signed-date>

</mandate>

<creditor-id>XY98ZZZ09999999999</creditor-id>

<consumer>

<first-name/>

<last-name/>

</consumer>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<parent-transaction-id>3aa87578-1a4c-11e5-b3a3-0050b65c678c</parent-transaction-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>e7c87536-2e7d-4cfc-abc8-9bb1d81907ca</merchant-account-id>

<transaction-id>3da64fb6-1a4c-11e5-b3a3-0050b65c678c</transaction-id>

<request-id>3864ca4a-eaac-4a65-968c-047676fd6101</request-id>

<transaction-type>credit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-06-24T10:37:39.000+02:00</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="EUR">1.01</requested-amount>

<parent-transaction-id>3aa87578-1a4c-11e5-b3a3-0050b65c678c</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>28862</order-number>

<descriptor>customerStatement 18009998888</descriptor>

<payment-methods>

<payment-method name="sepacredit"/>

</payment-methods>

<bank-account>

<iban>NL53INGB0654422370</iban>

<bic>INGBNL2A</bic>

</bank-account>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-01-05</signed-date>

</mandate>

<creditor-id>XY98ZZZ09999999999</creditor-id>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<consumer>

<first-name/>

<last-name/>

</consumer>

<provider-transaction-reference-id>7BE65FA70E</provider-transaction-reference-id>

<instrument-country>NL</instrument-country>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>e7c87536-2e7d-4cfc-abc8-9bb1d81907ca</merchant-account-id>

<transaction-id>3ddf60d2-1a4c-11e5-b3a3-0050b65c678c</transaction-id>

<request-id>3864ca4a-eaac-4a65-968c-047676fd6101</request-id>

<transaction-type>credit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-06-24T10:37:40.000+02:00</completion-time-stamp>

<statuses>

<status code="201.0000" description="bank:The resource was successfully created." provider-transaction-id="61ab74011ab6e13a797b00e47bf01106" severity="information"/>

</statuses>

<requested-amount currency="EUR">1.010000</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>28862</order-number>

<descriptor>customerStatement 18009998888</descriptor>

<payment-methods>

<payment-method name="sepacredit"/>

</payment-methods>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-01-05T00:00:00.000+01:00</signed-date>

</mandate>

<creditor-id>XY98ZZZ09999999999</creditor-id>

<api-id>---</api-id>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<provider-transaction-reference-id>7BE65FA70E</provider-transaction-reference-id>

<instrument-country>NL</instrument-country>

<Signature xmlns="http://www.w3.org/2000/09/xmldsig#">

<SignedInfo>

<CanonicalizationMethod Algorithm="http://www.w3.org/TR/2001/REC-xml-c14n-20010315"/>

<SignatureMethod Algorithm="http://www.w3.org/2000/09/xmldsig#rsa-sha1"/>

<Reference URI="">

<Transforms>

<Transform Algorithm="http://www.w3.org/2000/09/xmldsig#enveloped-signature"/>

</Transforms>

<DigestMethod Algorithm="http://www.w3.org/2000/09/xmldsig#sha1"/>

<DigestValue>aufM08TY4Xqa70knFRr93HXsy7I=</DigestValue>

</Reference>

</SignedInfo>

<SignatureValue>cFkjLvNakh/1lg+0kBhgSYvWymv8+09iPHeidjXy/J2Z8xptwXj6429cC/qYJxqX7gRCXhVMPBRv

kw4dX0n+PsXGHkPcqdDR2O1UshtgxSMoqaiOU+aHrZAS0UORW/23iSXl4ww9yYknphDQknCCXAkl

E1suX6eX34tUi1WNf1IVchDm6Og5wi5m1y7YaV5H5VT+YFsbKf5/wn+RMpDol97R6gRk97gKA5rd

jIU4atMRtyGz3aOkv2Gxejnh8dvB6PXCieK2MrsocOjEyoOvN2ZN5dzhgbOlvBrwo+Jc8E74tWti

22d5HUDxH1SwTXVnOJHylwxZP7Nog1LfUvpzzg==</SignatureValue>

<KeyInfo>

<X509Data>

<X509SubjectName>CN=Manoj Sahu,OU=Operations,O=Wirecard Elastic Payments,L=Toronto,ST=ON,C=CA</X509SubjectName>

<X509Certificate>MIIDcDCCAligAwIBAgIETgQWGTANBgkqhkiG9w0BAQUFADB6MQswCQYDVQQGEwJDQTELMAkGA1UE

CBMCT04xEDAOBgNVBAcTB1Rvcm9udG8xIjAgBgNVBAoTGVdpcmVjYXJkIEVsYXN0aWMgUGF5bWVu

dHMxEzARBgNVBAsTCk9wZXJhdGlvbnMxEzARBgNVBAMTCk1hbm9qIFNhaHUwHhcNMTEwNjI0MDQ0

NDA5WhcNMTQwMzIwMDQ0NDA5WjB6MQswCQYDVQQGEwJDQTELMAkGA1UECBMCT04xEDAOBgNVBAcT

B1Rvcm9udG8xIjAgBgNVBAoTGVdpcmVjYXJkIEVsYXN0aWMgUGF5bWVudHMxEzARBgNVBAsTCk9w

ZXJhdGlvbnMxEzARBgNVBAMTCk1hbm9qIFNhaHUwggEiMA0GCSqGSIb3DQEBAQUAA4IBDwAwggEK

AoIBAQCc8rTt4N5fNeVzlsRgOXKDE2YUSfJx7xXBozFZ3Vh3XQyy3IpIuEfZz7004k4HeonfTxCN

etBvJ9rgNc0Cxrk/euMj3pOUrE9WYN2eAXC0r5pUIAZhIAnSxUSaIF3JKBxf7gDAik5d8RT5HaJV

4n5cXJQ/uhAEYU3EGN/74UrD2UsOYD3VBXTJS5VgSi/c3IyLwhDbYIyU6j4fMKyHIlAMGzW7VgKD

2pqu6BRysqUVdEEAvW2OmyVqGVyPkm87EiHSMMSar3CvYYxYqBN2KBUjabkvnRWbIzyQuyUyDeUb

QmhVQKL0WlMb5ev65m2VjGyDTGL5jfB14rSXRMGzeJ+LAgMBAAEwDQYJKoZIhvcNAQEFBQADggEB

ADgkuN/e2IFy7JXdbjNJbKBd3HLvFvK87dv8qQ+HK4qfCxYXh6aYhbKHJSA6C2pbOD3HBXoyovZr

mk/KqOyUL+unVcR+APjxX4KP25sdkplgmeQ47CWxtKAHZUTtWwAVI/WhsX89SSucBfIS5TJ54e7m

02qvGoK8UA/IRbIQ6DZ9hEKV5VQKiMx3ubwwHGXfOWz2fKmeZBuTeY+HiTEH8KCHpfw2j8G+dDgU

jlp9LvjVNmJzfNBBk1Si0d/rhXmMzVSKj08tp1sPRK0/sJtJZBzQajpnsZ9NFfoJNdG13AzYwDP3

x/QspK0jYn1KZw1qz524VWoQoueR8Xj30A2jntA=</X509Certificate>

</X509Data>

</KeyInfo>

</Signature>

</payment>{

"payment" : {

"merchant-account-id" : {

"value" : "e7c87536-2e7d-4cfc-abc8-9bb1d81907ca"

},

"request-id" : "3864ca4a-eaac-4a65-968c-047676fd6101",

"transaction-type" : "credit",

"requested-amount" : {

"value" : 1.01,

"currency" : "EUR"

},

"parent-transaction-id" : "3aa87578-1a4c-11e5-b3a3-0050b65c678c",

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"payment-methods" : {

"payment-method" : [ {

"name" : "sepacredit"

} ]

},

"mandate" : {

"mandate-id" : "mandid",

"signed-date" : "2015-01-05"

},

"creditor-id" : "XY98ZZZ09999999999",

"periodic" : {

"periodic-type" : "recurring",

"sequence-type" : "recurring"

},

"consumer" : {

"first-name" : "",

"last-name" : ""

}

}

}{

"payment" : {

"merchant-account-id" : {

"value" : "e7c87536-2e7d-4cfc-abc8-9bb1d81907ca"

},

"transaction-id" : "3da64fb6-1a4c-11e5-b3a3-0050b65c678c",

"request-id" : "3864ca4a-eaac-4a65-968c-047676fd6101",

"transaction-type" : "credit",

"transaction-state" : "success",

"completion-time-stamp" : 1435135059000,

"statuses" : {

"status" : [ {

"value" : "",

"code" : "201.0000",

"description" : "The resource was successfully created.",

"severity" : "information"

} ]

},

"requested-amount" : {

"value" : 1.01,

"currency" : "EUR"

},

"parent-transaction-id" : "3aa87578-1a4c-11e5-b3a3-0050b65c678c",

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"order-number" : "28862",

"descriptor" : "customerStatement 18009998888",

"payment-methods" : {

"payment-method" : [ {

"name" : "sepacredit"

} ]

},

"bank-account" : {

"iban" : "NL53INGB0654422370",

"bic" : "INGBNL2A"

},

"mandate" : {

"mandate-id" : "mandid",

"signed-date" : "2015-01-05"

},

"creditor-id" : "XY98ZZZ09999999999",

"periodic" : {

"periodic-type" : "recurring",

"sequence-type" : "recurring"

},

"consumer" : {

"first-name" : "",

"last-name" : ""

},

"provider-transaction-reference-id" : "7BE65FA70E",

"instrument-country" : "NL"

}

}Payment Methods

Cross-Payment-Methods Referencing helps to reduce fraud in recurring payments, because the merchant can reference two payment methods.

The initial transaction has to be performed with a method that requires access credentials from the customer.

With the referencing of two payment methods the merchant can avoid that a SEPA Direct Debit transaction, if used as initial transaction, is returned after he has already provided the consumer with the purchased goods or services.

The main reasons for returned SEPA Direct Debit transaction are:

-

"Bank account not existing"

-

"Invalid bank data"

Cross-Payment-Methods Referencing is available, when the merchant has

-

several online banking payment methods configured within MAID.

-

installed Wirecard Payment Gateway backend and Payment Page integrations.

Cross-Payment-Methods Referencing is executed in two steps:

The initial transaction is placed by the customer actively via one of the supported online banking payment methods:

-

Sofort.

-

iDEAL

-

giropay

-

eps-Überweisung

If the initial transaction is successful, the bank details IBAN and BIC are saved in the database, but not returned in the response.

| Not every bank provides bank account data. Wirecard Payment Gateway can only process bank account data if provided by the bank. |

The subsequent transaction is a SEPA Direct Debit transaction. The merchant receives a transaction ID from the initial transaction which is used later to place a referenced SEPA Direct Debit transaction without knowing the bank account details as they are automatically connected to the transaction ID.

This functionality allows e.g. easier subscription management.

|

A clear position for the "periodic" tag cannot be established. It can be set either in the initial transaction iDEAL or in the subsequent transaction within the SEPA Direct Debit.

The advantages, setting it in the subsequent transaction are:

-

Integration of original payment method (e.g. iDEAL, Sofort., …) does not need to be amended.

-

If you are using SEPA as an additional payment option, the behavior where to send the periodic tags is identical.

| API Endpoint for referenced transactions for alternative payment methods is always: https://api-test.wirecard.com/engine/rest/payments/ |

Samples

This section describes a set of requests and responses in which the "periodic" tag is set right in the beginning, in the Request Initial iDEAL.

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41</merchant-account-id>

<request-id>b2ddf106-0f00-41da-b8af-64429b3ee329</request-id>

<transaction-type>get-url</transaction-type>

<payment-methods>

<payment-method name="ideal"/>

</payment-methods>

<requested-amount currency="EUR">2.31</requested-amount>

<order-description>test order</order-description>

<descriptor>customerStatement 18009998888</descriptor>

<bank-account>

<bic>INGBNL2A</bic>

</bank-account>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>43606</order-number>

<mandate>

<mandate-id>manid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<periodic>

<periodic-type>installment</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41</merchant-account-id>

<transaction-id>b8b27f18-4003-11e5-919b-005056a64448</transaction-id>

<request-id>b2ddf106-0f00-41da-b8af-64429b3ee329</request-id>

<transaction-type>get-url</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-08-11T07:07:08.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="EUR">2.31</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>43606</order-number>

<descriptor>customerStatement 18009998888</descriptor>

<payment-methods>

<payment-method url="https://idealtest.secure-ing.com/ideal/issuerSim.do?trxid=0050000102513955&ideal=prob" name="ideal"/>

</payment-methods>

<bank-account>

<bic>INGBNL2A</bic>

</bank-account>

<mandate>

<mandate-id>manid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<periodic>

<periodic-type>installment</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41</merchant-account-id>

<transaction-id>42d9e5e4-d3e8-4a1a-bc7a-7811648c5d38</transaction-id>

<request-id>b2ddf106-0f00-41da-b8af-64429b3ee329</request-id>

<transaction-type>debit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-08-^1T10:32:00.000+02:00</completion-time-stamp>

<statuses>

<status code="201.1126" description="ideal:Successful confirmation received from the bank." severity="information"/>

</statuses>

<requested-amount currency="EUR">2.31</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>43606</order-number>

<descriptor>customerStatement 18009998888</descriptor>

<payment-methods>

<payment-method name="ideal"/>

</payment-methods>

<mandate>

<mandate-id>manid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<api-id>---</api-id>

<periodic>

<periodic-type>installment</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

<Signature xmlns="http://www.w3.org/2000/09/xmldsig#">

<SignedInfo>

<CanonicalizationMethod Algorithm="http://www.w3.org/TR/2001/REC-xml-c14n-20010315"/>

<SignatureMethod Algorithm="http://www.w3.org/2000/09/xmldsig#rsa-sha1"/>

<Reference URI="">

<Transforms>

<Transform Algorithm="http://www.w3.org/2000/09/xmldsig#enveloped-signature"/>

</Transforms>

<DigestMethod Algorithm="http://www.w3.org/2000/09/xmldsig#sha1"/>

<DigestValue>bZHaJgxjFpyO7VnpTwaTWa3ynM8=</DigestValue>

</Reference>

</SignedInfo>

<SignatureValue>ZWOEjEbw1k4xfW85qTWSfaXFEPL4i1QuopVjmRctiZ844DYqninTi7qO6xRM4EbC3hBi5da2/yn1

EGBO6T3Z8FrlmQtOgoIV5iGBqWqDZMF+EB7UTwMXU+VQMNCzOLFBLgDacVCMHCuEvcWVKJO5y+SD

0abg8rOX1P/oaaLmHYSsFk7TC/s0BcGl7pb3VSW3KhOAIFx2t0FEEioE2+t7GUgVNPs8FlxnWHZ2

yQIFblEEMmFD5UrAmHJ/uUj8c4qmGgQ2EcdSSvUO8gy1LZisstQrN8GhwyvaimrSv/QKwvAAwTnO

+ms/TVEGoKuaKCZzxHPGquQFQ8pG5cdG+m/JjQ==</SignatureValue>

<KeyInfo>

<X509Data>

<X509SubjectName>CN=Manoj Sahu,OU=Operations,O=Wirecard Elastic Payments,L=Toronto,ST=ON,C=CA</X509SubjectName>

<X509Certificate>MIIDcDCCAligAwIBAgIETgQWGTANBgkqhkiG9w0BAQUFADB6MQswCQYDVQQGEwJDQTELMAkGA1UE

CBMCT04xEDAOBgNVBAcTB1Rvcm9udG8xIjAgBgNVBAoTGVdpcmVjYXJkIEVsYXN0aWMgUGF5bWVu

dHMxEzARBgNVBAsTCk9wZXJhdGlvbnMxEzARBgNVBAMTCk1hbm9qIFNhaHUwHhcNMTEwNjI0MDQ0

NDA5WhcNMTQwMzIwMDQ0NDA5WjB6MQswCQYDVQQGEwJDQTELMAkGA1UECBMCT04xEDAOBgNVBAcT

B1Rvcm9udG8xIjAgBgNVBAoTGVdpcmVjYXJkIEVsYXN0aWMgUGF5bWVudHMxEzARBgNVBAsTCk9w

ZXJhdGlvbnMxEzARBgNVBAMTCk1hbm9qIFNhaHUwggEiMA0GCSqGSIb3DQEBAQUAA4IBDwAwggEK

AoIBAQCc8rTt4N5fNeVzlsRgOXKDE2YUSfJx7xXBozFZ3Vh3XQyy3IpIuEfZz7004k4HeonfTxCN

etBvJ9rgNc0Cxrk/euMj3pOUrE9WYN2eAXC0r5pUIAZhIAnSxUSaIF3JKBxf7gDAik5d8RT5HaJV

4n5cXJQ/uhAEYU3EGN/74UrD2UsOYD3VBXTJS5VgSi/c3IyLwhDbYIyU6j4fMKyHIlAMGzW7VgKD

2pqu6BRysqUVdEEAvW2OmyVqGVyPkm87EiHSMMSar3CvYYxYqBN2KBUjabkvnRWbIzyQuyUyDeUb

QmhVQKL0WlMb5ev65m2VjGyDTGL5jfB14rSXRMGzeJ+LAgMBAAEwDQYJKoZIhvcNAQEFBQADggEB

ADgkuN/e2IFy7JXdbjNJbKBd3HLvFvK87dv8qQ+HK4qfCxYXh6aYhbKHJSA6C2pbOD3HBXoyovZr

mk/KqOyUL+unVcR+APjxX4KP25sdkplgmeQ47CWxtKAHZUTtWwAVI/WhsX89SSucBfIS5TJ54e7m

02qvGoK8UA/IRbIQ6DZ9hEKV5VQKiMx3ubwwHGXfOWz2fKmeZBuTeY+HiTEH8KCHpfw2j8G+dDgU

jlp9LvjVNmJzfNBBk1Si0d/rhXmMzVSKj08tp1sPRK0/sJtJZBzQajpnsZ9NFfoJNdG13AzYwDP3

x/QspK0jYn1KZw1qz524VWoQoueR8Xj30A2jntA=</X509Certificate>

</X509Data>

</KeyInfo>

</Signature>

</payment>{

"payment" : {

"merchant-account-id" : {

"value" : "36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41"

},

"request-id" : "b2ddf106-0f00-41da-b8af-64429b3ee329",

"transaction-type" : "get-url",

"requested-amount" : {

"value" : 2.31,

"currency" : "EUR"

},

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"order-number" : "43606",

"descriptor" : "customerStatement 18009998888",

"payment-methods" : {

"payment-method" : [ {

"name" : "ideal"

} ]

},

"bank-account" : {

"bic" : "INGBNL2A"

},

"mandate" : {

"mandate-id" : "manid",

"signed-date" : "2015-02-02"

},

"creditor-id" : "DE98ZZZ09999999999",

"periodic" : {

"periodic-type" : "installment",

"sequence-type" : "first"

}

}

}{

"payment" : {

"merchant-account-id" : {

"value" : "36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41"

},

"transaction-id" : "b8b27f18-4003-11e5-919b-005056a64448",

"request-id" : "b2ddf106-0f00-41da-b8af-64429b3ee329",

"transaction-type" : "get-url",

"transaction-state" : "success",

"completion-time-stamp" : 1439276828000,

"statuses" : {

"status" : [ {

"value" : "",

"code" : "201.0000",

"description" : "The resource was successfully created.",

"severity" : "information"

} ]

},

"requested-amount" : {

"value" : 2.31,

"currency" : "EUR"

},

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"order-number" : "43606",

"descriptor" : "customerStatement 18009998888",

"payment-methods" : {

"payment-method" : [ {

"url" : "https://idealtest.secure-ing.com/ideal/issuerSim.do?trxid=0050000102513955&ideal=prob",

"name" : "ideal"

} ]

},

"bank-account" : {

"bic" : "INGBNL2A"

},

"mandate" : {

"mandate-id" : "manid",

"signed-date" : "2015-02-02"

},

"creditor-id" : "DE98ZZZ09999999999",

"periodic" : {

"periodic-type" : "installment",

"sequence-type" : "first"

}

}

}|

Recurring Transaction Referencing iDEAL Payment

Referenced SEPA payment does not contain mandatory fields in the

request as these are taken from the initial iDEAL payment based on

parent transaction ID.

|

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41</merchant-account-id>

<request-id>72ae0263-384f-41cc-8caa-aa78330afca3</request-id>

<transaction-type>debit</transaction-type>

<requested-amount currency="EUR">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<payment-methods>

<payment-method name="sepadirectdebit"/>

</payment-methods>

<consumer>

<first-name/>

<last-name/>

</consumer>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<parent-transaction-id>42d9e5e4-d3e8-4a1a-bc7a-7811648c5d38</parent-transaction-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41</merchant-account-id>

<transaction-id>bcd853f6-4003-11e5-919b-005056a64448</transaction-id>

<request-id>72ae0263-384f-41cc-8caa-aa78330afca3</request-id>

<transaction-type>debit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-08-11T08:34:10.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="EUR">1.01</requested-amount>

<parent-transaction-id>b8b27f18-4003-11e5-919b-005056a64448</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>39849</order-number>

<descriptor>customerStatement 18009998888</descriptor>

<payment-methods>

<payment-method name="sepadirectdebit"/>

</payment-methods>

<bank-account>

<iban>NL53INGB0654422370</iban>

<bic>INGBNL2A</bic>

</bank-account>

<mandate>

<mandate-id>manid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<due-date>2015-08-17</due-date>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<consumer>

<first-name/>

<last-name/>

</consumer>

<provider-transaction-reference-id>261AD6D93C</provider-transaction-reference-id>

<instrument-country>NL</instrument-country>

</payment>{

"payment" : {

"merchant-account-id" : {

"value" : "36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41"

},

"request-id" : "72ae0263-384f-41cc-8caa-aa78330afca3",

"transaction-type" : "debit",

"requested-amount" : {

"value" : 1.01,

"currency" : "EUR"

},

"parent-transaction-id" : "b8b27f18-4003-11e5-919b-005056a64448",

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"payment-methods" : {

"payment-method" : [ {

"name" : "sepadirectdebit"

} ]

},

"periodic" : {

"periodic-type" : "recurring",

"sequence-type" : "recurring"

},

"consumer" : {

"first-name" : "",

"last-name" : ""

}

}

}{

"payment" : {

"merchant-account-id" : {

"value" : "36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41"

},

"transaction-id" : "bcd853f6-4003-11e5-919b-005056a64448",

"request-id" : "72ae0263-384f-41cc-8caa-aa78330afca3",

"transaction-type" : "debit",

"transaction-state" : "success",

"completion-time-stamp" : 1439282050000,

"statuses" : {

"status" : [ {

"value" : "",

"code" : "201.0000",

"description" : "The resource was successfully created.",

"severity" : "information"

} ]

},

"requested-amount" : {

"value" : 1.01,

"currency" : "EUR"

},

"parent-transaction-id" : "b8b27f18-4003-11e5-919b-005056a64448",

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"order-number" : "39849",

"descriptor" : "customerStatement 18009998888",

"payment-methods" : {

"payment-method" : [ {

"name" : "sepadirectdebit"

} ]

},

"bank-account" : {

"iban" : "NL53INGB0654422370",

"bic" : "INGBNL2A"

},

"mandate" : {

"mandate-id" : "manid",

"signed-date" : "2015-02-02"

},

"creditor-id" : "DE98ZZZ09999999999",

"due-date" : "2015-08-17",

"periodic" : {

"periodic-type" : "recurring",

"sequence-type" : "recurring"

},

"consumer" : {

"first-name" : "",

"last-name" : ""

},

"provider-transaction-reference-id" : "261AD6D93C",

"instrument-country" : "NL"

}

}|

Recurring Transaction Referencing SEPA Credit

This scenario is for a cross-payment-methods referenced SEPA Credit

transaction.

|

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41</merchant-account-id>

<request-id>30ba2c27-d8bb-47d2-ac02-f1ccf94e162c</request-id>

<transaction-type>credit</transaction-type>

<requested-amount currency="EUR">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<!-- optional

<email>john.doe@wirecard.com</email>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<country>CA</country>

</address> -->

</account-holder>

<!-- optional

<order-number></order-number> -->

<!-- optional

<descriptor>test</descriptor> -->

<payment-methods>

<payment-method name="sepacredit"/>

</payment-methods>

<!-- optional element consumer -->

<consumer>

<first-name/>

<last-name/>

</consumer>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<parent-transaction-id>96468896-3ffb-11e5-919b-005056a64448</parent-transaction-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41</merchant-account-id>

<transaction-id>b03c1d42-3ffb-11e5-919b-005056a64448</transaction-id>

<request-id>30ba2c27-d8bb-47d2-ac02-f1ccf94e162c</request-id>

<transaction-type>credit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-08-11T07:36:33.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="EUR">1.01</requested-amount>

<parent-transaction-id>96468896-3ffb-11e5-919b-005056a64448</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>11153</order-number>

<descriptor>customerStatement 18009998888</descriptor>

<payment-methods>

<payment-method name="sepacredit"/>

</payment-methods>

<bank-account>

<iban>NL53INGB0654422370</iban>

<bic>INGBNL2A</bic>

</bank-account>

<mandate>

<mandate-id>manid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<consumer>

<first-name/>

<last-name/>

</consumer>

<provider-transaction-reference-id>3E6B70E7B4</provider-transaction-reference-id>

<instrument-country>NL</instrument-country>

</payment>{

"payment" : {

"merchant-account-id" : {

"value" : "36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41"

},

"request-id" : "30ba2c27-d8bb-47d2-ac02-f1ccf94e162c",

"transaction-type" : "credit",

"requested-amount" : {

"value" : 1.01,

"currency" : "EUR"

},

"parent-transaction-id" : "96468896-3ffb-11e5-919b-005056a64448",

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"payment-methods" : {

"payment-method" : [ {

"name" : "sepacredit"

} ]

},

"periodic" : {

"periodic-type" : "recurring",

"sequence-type" : "recurring"

},

"consumer" : {

"first-name" : "",

"last-name" : ""

}

}

}{

"payment" : {

"merchant-account-id" : {

"value" : "36c1b68b-7a95-4f1b-bcdb-6b84bfbc5b41"

},

"transaction-id" : "b03c1d42-3ffb-11e5-919b-005056a64448",

"request-id" : "30ba2c27-d8bb-47d2-ac02-f1ccf94e162c",

"transaction-type" : "credit",

"transaction-state" : "success",

"completion-time-stamp" : 1439278593000,

"statuses" : {

"status" : [ {

"value" : "",

"code" : "201.0000",

"description" : "The resource was successfully created.",

"severity" : "information"

} ]

},

"requested-amount" : {

"value" : 1.01,

"currency" : "EUR"

},

"parent-transaction-id" : "96468896-3ffb-11e5-919b-005056a64448",

"account-holder" : {

"first-name" : "John",

"last-name" : "Doe"

},

"order-number" : "11153",

"descriptor" : "customerStatement 18009998888",

"payment-methods" : {

"payment-method" : [ {

"name" : "sepacredit"

} ]

},

"bank-account" : {

"iban" : "NL53INGB0654422370",

"bic" : "INGBNL2A"

},

"mandate" : {

"mandate-id" : "manid",

"signed-date" : "2015-02-02"

},

"creditor-id" : "DE98ZZZ09999999999",

"periodic" : {

"periodic-type" : "recurring",

"sequence-type" : "recurring"

},

"consumer" : {

"first-name" : "",

"last-name" : ""

},

"provider-transaction-reference-id" : "3E6B70E7B4",

"instrument-country" : "NL"

}

}Periodic In Subsequent Transaction

This section describes a set of requests and responses in which the "periodic" tag is set at a subsequent request, the SEPA Debit Recurring#1.

<?xml version="1.0" encoding="utf-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-resolver-category>RULE_MERCHANTACCOUNTS</merchant-account-resolver-category>

<request-id>{set unique request ID}</request-id>

<transaction-type>debit</transaction-type>

<requested-amount currency="EUR">112.00</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>test@test.com</email>

<phone />

<address>

<street1>Einsteinring 35</street1>

<street2 />

<city>Munich</city>

<state>BY</state>

<country>DE</country>

<postal-code>85609</postal-code>

</address>

</account-holder>

<notifications>

<notification url="https://merchant.com/ipn.php"/>

</notifications>

<ip-address>128.0.000.0</ip-address>

<order-number>Wirecard Test</order-number>

<descriptor>descriptor test</descriptor>

<payment-methods>

<payment-method name="ideal" />

</payment-methods>

<bank-account>

<bic>INGBNL2A</bic>

</bank-account>

<cancel-redirect-url>https://sandbox-engine.thesolution.com/shop/cancel.html</cancel-redirect-url>

<success-redirect-url>https://sandbox-engine.thesolution.com/shop/success.html</success-redirect-url>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>adb45327-170a-460b-9810-9008e9772f5f</merchant-account-id>

<transaction-id>063b54d7-0272-4b6e-ad13-f6f4c25c4759</transaction-id>

<request-id>{{$guid}}</request-id>

<transaction-type>debit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2017-02-23T09:01:03.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information" />

</statuses>

<requested-amount currency="EUR">112.00</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>test@test.com</email>

<phone>

</phone>

<address>

<street1>Einsteinring 35</street1>

<street2>

</street2>

<city>Munich</city>

<state>BY</state>

<country>DE</country>

<postal-code>85609</postal-code>

</address>

</account-holder>

<ip-address>128.0.000.0</ip-address>

<order-number>Wirecard Test</order-number>

<descriptor>descriptor test</descriptor>

<notifications>

<notification url="https://merchant.com/ipn.php"/>

</notifications>

<payment-methods>

<payment-method url="https://idealtest.secure-ing.com/ideal/issuerSim.do?trxid=0050000126213329&ideal=prob" name="ideal" />

</payment-methods>

<bank-account>

<bic>INGBNL2A</bic>

</bank-account>

<cancel-redirect-url>https://sandbox-engine.thesolution.com/shop/cancel.html</cancel-redirect-url>

<success-redirect-url>https://sandbox-engine.thesolution.com/shop/success.html</success-redirect-url>

</payment>| Receive Notification to get the transaction ID from the iDEAL debit to use as reference for SEPA transactions. |

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>ce7b6129-4ff1-42b9-8dcb-723149f5bbbe</merchant-account-id>

<request-id>{set unique request ID}</request-id>

<transaction-type>credit</transaction-type>

<requested-amount currency="EUR">1.00</requested-amount>

<notifications>

<notification url="https://merchant.com/ipn.php"/>

</notifications>

<payment-methods>

<payment-method name="sepacredit" />

</payment-methods>

<parent-transaction-id>0ceed077-fd9d-47d2-944d-af1488fd3ece</parent-transaction-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>ce7b6129-4ff1-42b9-8dcb-723149f5bbbe</merchant-account-id>

<transaction-id>edf03006-90f9-4daa-b903-ca6a98aab956</transaction-id>

<request-id>{{$guid}}</request-id>

<transaction-type>credit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2017-02-23T09:03:19.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information" />

</statuses>

<requested-amount currency="EUR">1.00</requested-amount>

<parent-transaction-id>0ceed077-fd9d-47d2-944d-af1488fd3ece</parent-transaction-id>

<account-holder>

<first-name>Hr</first-name>

<last-name>E G H Küppers en/of MW M.J. Küpp</last-name>

<email>test@test.com</email>

<phone>

</phone>

<address>

<street1>Einsteinring 35</street1>

<street2>

</street2>

<city>Munich</city>

<state>BY</state>

<country>DE</country>

<postal-code>85609</postal-code>

</address>

</account-holder>

<order-number>Wirecard Test</order-number>

<descriptor>descriptor test</descriptor>

<notifications>

<notification url="https://merchant.com/ipn.php" />

</notifications>

<payment-methods>

<payment-method name="sepacredit" />

</payment-methods>

<bank-account>

<iban>NL53INGB0654422370</iban>

<bic>INGBNL2A</bic>

</bank-account>

<api-id>---</api-id>

<cancel-redirect-url>https://sandbox-engine.thesolution.com/shop/cancel.html</cancel-redirect-url>

<success-redirect-url>https://sandbox-engine.thesolution.com/shop/success.html</success-redirect-url>

<provider-transaction-reference-id>C6C38BB6AA</provider-transaction-reference-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>ce7b6129-4ff1-42b9-8dcb-723149f5bbbe</merchant-account-id>

<request-id>{set unique request ID}</request-id>

<transaction-type>debit</transaction-type>

<requested-amount currency="EUR">55.00</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<payment-methods>

<payment-method name="sepadirectdebit" />

</payment-methods>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<consumer>

<first-name>

</first-name>

<last-name>

</last-name>

</consumer>

<notifications>

<notification url="https://merchant.com/ipn.php"/>

</notifications>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

<parent-transaction-id>0ceed077-fd9d-47d2-944d-af1488fd3ece</parent-transaction-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>ce7b6129-4ff1-42b9-8dcb-723149f5bbbe</merchant-account-id>

<transaction-id>aaf7d691-e83d-4907-b0d5-eaba18099a54</transaction-id>

<request-id>{{$guid}}</request-id>

<transaction-type>debit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2017-02-23T09:11:50.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information" />

</statuses>

<requested-amount currency="EUR">55.00</requested-amount>

<parent-transaction-id>0ceed077-fd9d-47d2-944d-af1488fd3ece</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<address>

<street1>Einsteinring 35</street1>

<street2>

</street2>

<city>Munich</city>

<state>BY</state>

<country>DE</country>

<postal-code>85609</postal-code>

</address>

</account-holder>

<order-number>Wirecard Test</order-number>

<descriptor>descriptor test</descriptor>

<notifications>

<notification url="https://merchant.com/ipn.php" />

</notifications>

<payment-methods>

<payment-method name="sepadirectdebit" />

</payment-methods>

<bank-account>

<iban>NL53INGB0654422370</iban>

<bic>INGBNL2A</bic>

</bank-account>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<api-id>---</api-id>

<cancel-redirect-url>https://sandbox-engine.thesolution.com/shop/cancel.html</cancel-redirect-url>

<success-redirect-url>https://sandbox-engine.thesolution.com/shop/success.html</success-redirect-url>

<due-date>2017-03-06</due-date>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

<consumer>

<first-name>

</first-name>

<last-name>

</last-name>

</consumer>

<provider-transaction-reference-id>DA2DA22316</provider-transaction-reference-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>ce7b6129-4ff1-42b9-8dcb-723149f5bbbe</merchant-account-id>

<request-id>{set unique request ID}</request-id>

<transaction-type>debit</transaction-type>

<requested-amount currency="EUR">44.00</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<payment-methods>

<payment-method name="sepadirectdebit" />

</payment-methods>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<consumer>

<first-name>

</first-name>

<last-name>

</last-name>

</consumer>

<notifications>

<notification url="https://merchant.com/ipn.php"/>

</notifications>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<parent-transaction-id>aaf7d691-e83d-4907-b0d5-eaba18099a54</parent-transaction-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>ce7b6129-4ff1-42b9-8dcb-723149f5bbbe</merchant-account-id>

<transaction-id>adf766c1-3ac5-4ca8-8255-db47142e181e</transaction-id>

<request-id>{{$guid}}</request-id>

<transaction-type>debit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2017-02-23T09:15:27.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information" />

</statuses>

<requested-amount currency="EUR">44.00</requested-amount>

<parent-transaction-id>aaf7d691-e83d-4907-b0d5-eaba18099a54</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<address>

<street1>Einsteinring 35</street1>

<street2>

</street2>

<city>Munich</city>

<state>BY</state>

<country>DE</country>

<postal-code>85609</postal-code>

</address>

</account-holder>

<order-number>Wirecard Test</order-number>

<descriptor>descriptor test</descriptor>

<notifications>

<notification url="https://merchant.com/ipn.php" />

</notifications>

<payment-methods>

<payment-method name="sepadirectdebit" />

</payment-methods>

<bank-account>

<iban>NL53INGB0654422370</iban>

<bic>INGBNL2A</bic>

</bank-account>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<api-id>---</api-id>

<cancel-redirect-url>https://sandbox-engine.thesolution.com/shop/cancel.html</cancel-redirect-url>

<success-redirect-url>https://sandbox-engine.thesolution.com/shop/success.html</success-redirect-url>

<due-date>2017-03-01</due-date>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<consumer>

<first-name>

</first-name>

<last-name>

</last-name>

</consumer>

<provider-transaction-reference-id>FEE023CA5D</provider-transaction-reference-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>ce7b6129-4ff1-42b9-8dcb-723149f5bbbe</merchant-account-id>

<request-id>{set unique request ID}</request-id>

<transaction-type>debit</transaction-type>

<requested-amount currency="EUR">33.00</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<payment-methods>

<payment-method name="sepadirectdebit" />

</payment-methods>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<consumer>

<first-name>

</first-name>

<last-name>

</last-name>

</consumer>

<notifications>

<notification url="https://merchant.com/ipn.php"/>

</notifications>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<parent-transaction-id>aaf7d691-e83d-4907-b0d5-eaba18099a54</parent-transaction-id>

</payment><?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>ce7b6129-4ff1-42b9-8dcb-723149f5bbbe</merchant-account-id>

<transaction-id>62be2a49-c4a3-43c0-8ed0-65a10e68b199</transaction-id>

<request-id>{{$guid}}</request-id>

<transaction-type>debit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2017-02-23T09:16:31.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="The resource was successfully created." severity="information" />

</statuses>

<requested-amount currency="EUR">33.00</requested-amount>

<parent-transaction-id>aaf7d691-e83d-4907-b0d5-eaba18099a54</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<address>

<street1>Einsteinring 35</street1>

<street2>

</street2>

<city>Munich</city>

<state>BY</state>

<country>DE</country>

<postal-code>85609</postal-code>

</address>

</account-holder>

<order-number>Wirecard Test</order-number>

<descriptor>descriptor test</descriptor>

<notifications>

<notification url="https://merchant.com/ipn.php" />

</notifications>

<payment-methods>

<payment-method name="sepadirectdebit" />

</payment-methods>

<bank-account>

<iban>NL53INGB0654422370</iban>

<bic>INGBNL2A</bic>

</bank-account>

<mandate>

<mandate-id>mandid</mandate-id>

<signed-date>2015-02-02</signed-date>

</mandate>

<creditor-id>DE98ZZZ09999999999</creditor-id>

<api-id>---</api-id>

<cancel-redirect-url>https://sandbox-engine.thesolution.com/shop/cancel.html</cancel-redirect-url>

<success-redirect-url>https://sandbox-engine.thesolution.com/shop/success.html</success-redirect-url>

<due-date>2017-03-01</due-date>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<consumer>

<first-name>

</first-name>

<last-name>

</last-name>

</consumer>

<provider-transaction-reference-id>B9280973C8</provider-transaction-reference-id>

</payment>Instrument Country Bounceback

Since 2015 the new VAT rules raised by the EU are applicable for companies established in a EU member state and supply telecommunications, broadcasting and electronic services in the e-commerce business. The company must charge the VAT of the EU country the consumer belongs to.

The bounce back feature can be used by transmitting the two-digit country code via:

<instrument-country></instrument-country>

It is available for the following payment methods:

-

Credit Card

-

SEPA Direct Debit

-

Paypal

-

Sofort.

-

iDEAL

-

giropay (if an IBAN is sent)

-

Carrier Billing

The feature was implemented to support digital merchants to handle the new VAT rules raised by the EU in a more efficient way.

It can be enabled if a merchant intends to catch this information in the XML response.

Instant Payment Notification

The Wirecard Payment Gateway has a built-in notification capability. An Instant Payment Notification (IPN) informs the merchant about the final status of a transaction.

There are two types of notifications:

-

HTTP(S) (Web Server POST)

-

SMTP (Email prefixed with 'mailto')

The following formats are currently supported:

-

application/x-www-form-urlencoded

-

application/xml

-

application/json

-

application/json-signed

Configuration

When the merchant wants to receive a notification, he can either

-

specify a URL as part the merchant account setup; or

-

include either an email address or a URL as part of each transaction request

|

For request based IPN configuration, the request should contain the IPN notifications element.

|

|

In case there is no format specified in the request then the format specified in the merchant configuration is used. If there is no IPN format in the configuration, then NVP response is used for HPP/EPP requests or application/xml for others by default. Be aware that just one notification format can be set for all notifications sent to the specified URLs. |

Request a Notification in JSON Format

The following example shows how the Wirecard Payment Gateway can be configured to send notifications as JSON format:

|

Signed JSON Notifications

To request an application/json-signed notification, switch the

format value. Compared to the default JSON notification, signed

notifications are base64 encoded and include a security signature: this

means you can verify that the notification comes from Wirecard, but need

to decode it before you can see its content.

|

<notifications format="application/json>

<?xml version="1.0" encoding="UTF-8"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>${unique for each merchant account}</merchant-account-id>

<request-id>${unique for each request}</request-id>

<transaction-type>debit</transaction-type>

<requested-amount currency="EUR">1.00</requested-amount>

<parent-transaction-id>${unique for each parent transaction}</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>12345</order-number>

<descriptor>customerStatement 12003332222</descriptor>

<notifications format="application/json">

<notification url="https://www.merchant.com/special-IPN"></notification>

</notifications>

<payment-methods>

<payment-method name="${payment method}"/>

</payment-methods>

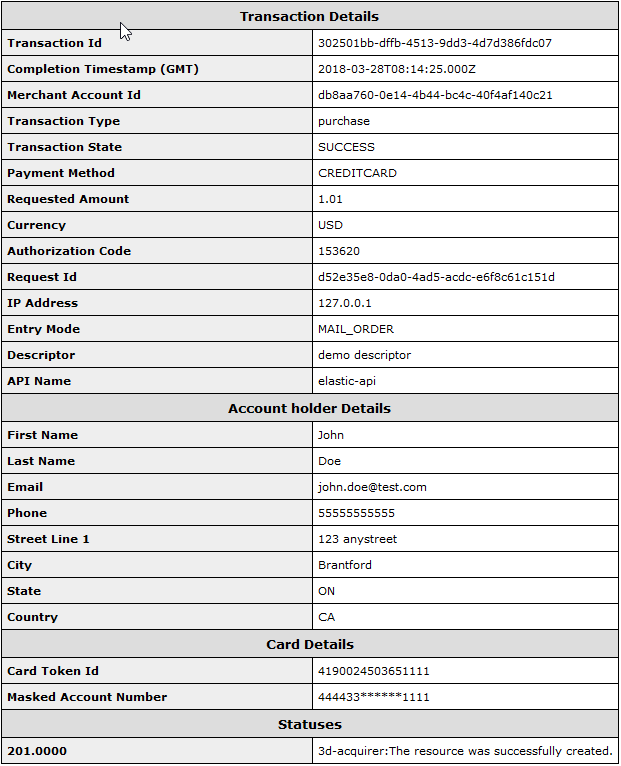

</payment>The notification will look like this:

{

"payment": {

"statuses": {

"status": [{

"code": "201.0000",

"description": "3d-acquirer:The resource was successfully created.",

"severity": "information"

}]

},

"descriptor": "demo descriptor",

"merchant-account-id": {

"value": "04bfef3e-6029-4bdb-8bf7-951cb36077ab"

},

"transaction-id": "d5c773d7-2e03-4513-9f7f-343de0b35e4d",

"request-id": "969fed83-252e-44d8-956d-74c4a42558bd",

"transaction-type": "purchase",

"transaction-state": "success",

"completion-time-stamp": 1522225304000,

"requested-amount": {

"value": 1.01,

"currency": "USD"

},

"account-holder": {

"email": "john.doe@wirecard.com",

"phone": "55555555555",

"address": {

"street1": "123 anystreet",

"city": "Brantford",

"state": "ON",

"country": "CA"

},

"first-name": "John",

"last-name": "Doe"

},

"card-token": {

"token-id": "4190024503651111",

"masked-account-number": "444433******1111"

},

"ip-address": "127.0.0.1",

"payment-methods": {

"payment-method": [{

"name": "creditcard"

}]

},

"authorization-code": "153620",

"api-id": "elastic-api",

"entry-mode": "mail-order"

}

}response-signature-base64: RfEJZDauGzMIvyzbR6n6qjjqhwDk9yUTKECdhWtPAiw=

response-signature-algorithm: HmacSHA256

response-base64: ewogICJkZXNjcmlwdG9yIiA6ICJkZW1vIGRlc2NyaXB0b3IiLAogICJzdGF0dXNlcyIgOiB7CiAgICAic3RhdHVzIiA6IFsgewogICAgICAiY29kZSIgOiAiMjAxLjAwMDAiLA

ogICAgICAic2V2ZXJpdHkiIDogImluZm9ybWF0aW9uIiwKICAgICAgImRlc2NyaXB0aW9uIiA6ICIzZC1hY3F1aXJlcjpUaGUgcmVzb3VyY2Ugd2FzIHN1Y2Nlc3NmdWxseSBjcmVhdGVkLiIKICAgI

H0gXQogIH0sCiAgImFjY291bnQtaG9sZGVyIiA6IHsKICAgICJmaXJzdC1uYW1lIiA6ICJKb2huIiwKICAgICJsYXN0LW5hbWUiIDogIkRvZSIKICB9LAogICJzdWNjZXNzLXJlZGlyZWN0LXVybCIg

OiAiaHR0cDovL2xvY2FsaG9zdDo4MDgwL3Nob3Avc3VjY2Vzcy5qc3AiLAogICJmYWlsLXJlZGlyZWN0LXVybCIgOiAiaHR0cDovL2xvY2FsaG9zdDo4MDgwL3Nob3AvZXJyb3IuanNwIiwKICAibWF

uZGF0ZSIgOiB7CiAgICAibWFuZGF0ZS1pZCIgOiAiMTIzNCIsCiAgICAic2lnbmVkLWNpdHkiIDogIjEyMzQiLAogICAgInNpZ25hdHVyZS1pbWFnZSIgOiAiMTIzNCIKICB9LAogICJwYXltZW50LW

1ldGhvZHMiIDogewogICAgInBheW1lbnQtbWV0aG9kIiA6IFsgewogICAgICAibmFtZSIgOiAiY3JlZGl0Y2FyZCIKICAgIH0gXQogIH0sCiAgInJlcXVlc3QtaWQiIDogImY2YjIxMWZkLWQxNWMtN

DQzNC1iNTI2LWM1YmU3ODM1ZmRhZCIsCiAgIm1lcmNoYW50LWFjY291bnQtaWQiIDogewogICAgInZhbHVlIiA6ICJmZjM5ZTZmZC0zNWY0LTExZTUtOWU5Yi1mODE2NTQ2MzIzMjgiCiAgfSwKICAi

dHJhbnNhY3Rpb24tdHlwZSIgOiAiYXV0aG9yaXphdGlvbiIsCiAgInJlcXVlc3RlZC1hbW91bnQiIDogewogICAgInZhbHVlIiA6IDEwLjEsCiAgICAiY3VycmVuY3kiIDogIkVVUiIKICB9LAogICJ

0cmFuc2FjdGlvbi1pZCIgOiAiY2U5MGQ4ZjUtMDUzMC00OGM0LTkyMDEtMDFiN2RiNDBkMjFkIiwKICAidHJhbnNhY3Rpb24tc3RhdGUiIDogInN1Y2Nlc3MiLAogICJjb21wbGV0aW9uLXRpbWUtc3

RhbXAiIDogIjIwMTctMTAtMjdUMDg6MzA6NDUiLAogICJjYXJkLXRva2VuIiA6IHsKICAgICJ0b2tlbi1pZCIgOiAiNDI0MzMxMjcwNzUxMTExMSIsCiAgICAibWFza2VkLWFjY291bnQtbnVtYmVyI

iA6ICI0NDQ0MzMqKioqKioxMTExIgogIH0sCiAgImF1dGhvcml6YXRpb24tY29kZSIgOiAiMTUzNjIwIiwKICAiYXBpLWlkIiA6ICJ1cDMtZ3BwIiwKICAib3JkZXItaXRlbXMiIDogewogICAgIm9y

ZGVyLWl0ZW0iIDogWyB7CiAgICAgICJuYW1lIiA6ICJNVU5JQ0ggLSBWSUVOTkEiLAogICAgICAiYW1vdW50IiA6IHsKICAgICAgICAidmFsdWUiIDogMTAuMSwKICAgICAgICAiY3VycmVuY3kiIDo

gIkVVUiIKICAgICAgfSwKICAgICAgImRlc2NyaXB0aW9uIiA6ICIoT1MxMTIpIHwgMWggMTBtaW4iLAogICAgICAicXVhbnRpdHkiIDogMQogICAgfSBdCiAgfSwKICAiY3JlZGl0b3ItaWQiIDogIj

EyMzQiCn0=To verify a signed notification, check the signature data against the Secret Key you received during merchant configuration:

import javax.crypto.Mac;

import javax.crypto.spec.SecretKeySpec;

import javax.xml.bind.DatatypeConverter;

...

private String merchantSecretKey = "merchantSecretKey";

public boolean isValidSignature(String responseBase64, String responseBase64Signature, String responseSignatureAlgorithm) throws Exception {

Mac mac = Mac.getInstance(responseSignatureAlgorithm);

mac.init(new SecretKeySpec(merchantSecretKey.getBytes("UTF-8"), responseSignatureAlgorithm));

return responseBase64Signature != null && responseBase64Signature.equals(DatatypeConverter.printBase64Binary(mac.doFinal(responseBase64.getBytes("UTF-8"))));

}Request a Notification in XML Format

<notifications format="application/xml">

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>6f2c9d44-7eb0-4449-94cd-28d44c177320</merchant-account-id>

<transaction-id>c2dcebc1-6c8b-4d87-b7d0-770df740116c</transaction-id>

<request-id>3c5170d9-3ede-444b-bacf-b0cf5d5f93c2</request-id>

<transaction-type>purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-03-28T08:36:30.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>55555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

</address>

</account-holder>

<card-token>

<token-id>4585779929881111</token-id>

<masked-account-number>444433******1111</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<descriptor>demo descriptor</descriptor>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<authorization-code>153620</authorization-code>

<api-id>elastic-api</api-id>

<entry-mode>mail-order</entry-mode>

</payment>It is possible to set up conditional notifications based on the state of the transaction. For example, it is possible to instruct a notification to only occur on 'failed' or 'successful' transactions.

| Notification Type | Notification Tag in Request | Possible Extensions of URL | Ports | Possible Extensions of transaction-state

|

|---|---|---|---|---|

HTTP(S) |

|

any configured URL |

80, 443, 5500 |

if URL <> empty and `transaction-state` = empty all notifications go to that URL or if URL <> empty and `transaction-state` <> empty depending on the transaction-state (success, failed, in-progress, etc) the notification goes to the corresponding URL. |

SMTP |

|

if URL <> empty and |

A request, which defines a URL to be used, when the payment process will fail:

<?xml version="1.0" encoding="UTF-8"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>${unique for each merchant account}</merchant-account-id>

<request-id>${unique for each request}</request-id>

<transaction-type>debit</transaction-type>

<requested-amount currency="EUR">1.00</requested-amount>

<parent-transaction-id>${unique for each parent transaction}</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>12345</order-number>

<descriptor>customerStatement 12003332222</descriptor>

<notifications>

<notification url="https://www.merchant.com/errorURL" transaction-state="failed"/>

</notifications>

<payment-methods>

<payment-method name="${payment method}"/>

</payment-methods>

</payment>Notification Examples

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>${unique for each merchant account}</merchant-account-id>

<transaction-id>${unique for each transaction}</transaction-id>

<request-id>${unique for each request}</request-id>

<transaction-type>authorization</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2017-06-19T10:00:36.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information" provider-transaction-id="C123456789876543212345"/>

</statuses>

<avs-code>U</avs-code>

<csc-code>P</csc-code>

<requested-amount currency="USD">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<street2></street2>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

</address>

</account-holder>

<card-token>

<token-id>${unique for each token}</token-id>

<masked-account-number>111111******1111</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<descriptor>demo descriptor</descriptor>

<notifications>

<notification transaction-state="failed" url="https://www.merchant.com/IPN"></notification>

<notification url="mailto:admin@merchant.com"></notification>

</notifications>

<authorization-code>123456</authorization-code>

<api-id>elastic-api</api-id>

</payment><?xml version="1.0" encoding="UTF-8"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction">

<merchant-account-id>${unique for each merchant account}</merchant-account-id>

<transaction-id>${unique for each transaction}</transaction-id>

<request-id>${unique for each request}</request-id>

<transaction-type>debit</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2017-06-19T10:22:17.000Z</completion-time-stamp>

<statuses>

<status code="201.1126" description="qtill:Successful confirmation received from the bank." severity="information"/>

</statuses>

<requested-amount currency="EUR">1.00</requested-amount>

<parent-transaction-id>${unique for each parent transaction}</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

</account-holder>

<order-number>12345</order-number>

<descriptor>customerStatement 12003332222</descriptor>

<notifications>

<notification transaction-state="failed" url="https://www.merchant.com/IPN"></notification>

<notification url="mailto:admin@merchant.com"></notification>

</notifications>

<payment-methods>

<payment-method name="${payment method}"/>

</payment-methods>

<api-id>---</api-id>

<Signature xmlns="http://www.w3.org/2000/09/xmldsig#">

<SignedInfo>

<CanonicalizationMethod Algorithm="http://www.w3.org/TR/2001/REC-xml-c14n-20010315"/>

<SignatureMethod Algorithm="http://www.w3.org/2001/04/xmldsig-more#rsa-sha256"/>

<Reference URI="">

<Transforms>

<Transform Algorithm="http://www.w3.org/2000/09/xmldsig#enveloped-signature"/>

</Transforms>

<DigestMethod Algorithm="http://www.w3.org/2001/04/xmlenc#sha256"/>

<DigestValue>uJWSjDzaJg3C04055Q/X6ZSiE6Fpivc1TAfdff9Ozfo=</DigestValue>

</Reference>

</SignedInfo>

<SignatureValue>I3DM296RHzvbZV4h30q5PAMv0/16JcSuN04a2OcYlA9KOnfi8nM8QQC39VfrCdTB/pvaI62b4plq

bjkth9Lwew09NXGcBGcOKmIAX7/pncpiETHiUmZKkYca4vVA2WxJcVDIyc2ZXvN8o0PByDYvdejn

oMAsfKPMOAkDhKLrRFE/MGgeuvtNH/FCXAqRv5JNfWEp8Ua91IXYT64XT6MxkKncmHGyDf/BE3ns

/dfyn2pWJPzs6EvTDoRmaCQPaCeLgTUVvbgABOE1TPZ89PIkbiaoJAKxSejwaCScwx2cKOzvqA01

vpcem1R1mEchxnafACZBQVy+Xme5gqL2F2PNO8MCtywXrRGsbV1mbhpIj5Apu/mj7C7xnTsJAf0k

t5y3y11hjeprallyQe2DYrbrEOYkanNNkZXouicuaelPJ9QWlb9HTDz7Ris95b6hzRrNDSgeoEdB

152wSYymdtyYXE1ViUDPkOi2jiAMMwmf2Xtt+Wpeatx/TlTyA14/+QJ+bn7ZgynYw4OUU5ps/KJD

ExE8TG4TCKcJdcjdEd0dVGb5mC9+SHLRATrZJxw+VwpwFDVFjbpxgcKl/RlY/5qWe/ihrPrCJeoW

Q0YN9ljXmiCmeSyeOVl8pEM6uANL24byLIF3A7YNs1t7fWfALckE5PQX6X/9lZGAvYH03o+kLCE=</SignatureValue>

<KeyInfo>

<X509Data>

<X509SubjectName>L=Ascheim,2.5.4.4=#130642617965726e,CN=api-qa.wirecard.sys,OU=Operations,O=Wirecard Technologies GmbH,C=DE</X509SubjectName>

<X509Certificate>MIIF4jCCBMqgAwIBAgICLGswDQYJKoZIhvcNAQELBQAwWzELMAkGA1UEBhMCREUxETAPBgNVBAoT

CFdpcmVjYXJkMTkwNwYDVQQDFDB3aXJlY2FyZC1EUS1NVUMtaW50ZXJuYWwtd2Vic2VydmljZS1p

c3N1aW5nQ0FfMDIwHhcNMTYxMjE0MTQzNzQ2WhcNMTgxMjE0MTQzNzQ2WjCBiDELMAkGA1UEBhMC

REUxIzAhBgNVBAoTGldpcmVjYXJkIFRlY2hub2xvZ2llcyBHbWJIMRMwEQYDVQQLEwpPcGVyYXRp

b25zMRwwGgYDVQQDExNhcGktcWEud2lyZWNhcmQuc3lzMQ8wDQYDVQQEEwZCYXllcm4xEDAOBgNV

BAcTB0FzY2hlaW0wggIiMA0GCSqGSIb3DQEBAQUAA4ICDwAwggIKAoICAQDJuFgv7WVoBdbfDBhN

SVJAwEe5fJ/liTFq/efCLOzJglN57ncLlsXE8RFsgu3vh5P/7Fu5K9b3rRxFrdH27A3qBUfQb5QM

EoeUawiCQSxJy4C1/iXfN7VUEfVWLRhJFSO3+oIcixN8X4EWk26YHPNKaxPmtNi+UrFlhKSUjgcf

2QwS7eKyoHk//i4lJ2Pm8N5yYNSI9EFQXpfQneAIT6I4musFWsVzSnmTjdFo7p62TJflZcz9V0ON

i1cqgXcr/5B1RMkz41JbEPOTZxEO5tl8U8GzkDAdjRncSn4dsNQKysuJOudmIQZKmEvvCZ66KAJ4

yStzODVjUv26zvOOGM5IXARRB5jgeyZpuWuaGVMe0MK90J6B8KIvjfpGfcx4HoRAGylbPxLlFdn2

g+w81d0KWwu2DP8tMa3sPBGBqELCuICnQz9Cg3r+4MNvmGGShg1j3vxJmAHfrtDv/ZIk4l5txo/L

//iwxlXBpXWxgO02PcAgFBpcWrSfFrSofhO5Ve7f44KBMvBdXzDMKy5BAiqz7Crs89Px1dRXSwAF

P8vcLsIMiEa9UK0i7pVKb1JKv2zY7iSKBR+0scwNQ+1eud9fgN4KPtZMPn90r+qv+NIQVZ+3j3uH

ijcNZACbJSETmt5npc/Kn9WvYIPWz1UTJU/lA8+PUKf6Efgpa4MtXIjaWwIDAQABo4IBgDCCAXww

EQYDVR0OBAoECEDTetAg6sf8MBMGA1UdIwQMMAqACENsHhbUPQUOMAsGA1UdDwQEAwIE8DCCAUMG

A1UdHwSCATowggE2MIIBMqCCAS6gggEqhoHVbGRhcDovL3dpcmVjYXJkLmxhbi9DTj13aXJlY2Fy

ZC1EUS1NVUMtaW50ZXJuYWwtd2Vic2VydmljZS1pc3N1aW5nQ0FfMDIsQ049Q0RQLENOPVB1Ymxp

YyBLZXkgU2VydmljZXMsQ049U2VydmljZXMsQ049Q29uZmlndXJhdGlvbixkYz13aXJlY2FyZCxk

Yz1sYW4/Y2VydGlmaWNhdGVSZXZvY2F0aW9uTGlzdD9iYXNlP29iamVjdENsYXNzPUNSTERpc3Ry

aWJ1dGlvblBvaW50hlBodHRwOi8vY3JsLndpcmVjYXJkLmxhbi9DUkxfd2lyZWNhcmQtRFEtTVVD

LWludGVybmFsLXdlYnNlcnZpY2UtaXNzdWluZ0NBXzAyLmNybDANBgkqhkiG9w0BAQsFAAOCAQEA

TRhKA9IiGvF5GPaUOdf0aQsWT+NevciPfh7RWUE1wM4xU1Zimrj3Ey27qBhmZgbpzkLKcBugW4z7

KK8kwBwpf4OZNhMBZNevE6AbllWNcSy5GZFFmfRm9CUwEdAyZYSEul0ncPOr9qczFhQV296dqdv3

3/j0l+TnOPJFXXazrSsIBtBB1DnJMHZ9A591Y9BZeoLMfBs5x1PQfTkEiJbUO5yhANd0GmxWrKIb

nJaL9ovrceEcmIpIDlb9qe++us87pMn0QBK+y/QDjjmOBkUNZ27QVsNnrl7Sk/hA8pQPw6ukd1+u

hvXVMX/EVZt5y1Ip3v0YW7qUaRH0dW/q84OISg==</X509Certificate>

</X509Data>

</KeyInfo>

</Signature>