Credit Card

REST API

Payment Mode, Countries and Currencies

Payment Mode |

|

|---|---|

Countries |

Depends on the licensed area of the financial institution/acquirer. Wirecard Bank, for example, is licensed to process payments globally. |

Currencies |

VISA and MC support basically all currencies. For more information, go to their respective manuals. JCB and UPI require an explicit setup of transaction currencies as part of the acquirer license agreement. |

Communication Formats

This table illustrates how credit card notifications are encoded and which formats and methods can be used for requests and responses.

Requests |

Format |

XML |

|---|---|---|

Methods |

POST |

|

Responses |

Format |

XML |

Methods |

POST |

|

IPN Encodement |

Please follow the instructions given at Instant Payment Notification to set up IPN. |

|

Test Credentials

URL (Endpoint) |

|

|---|

Refer to one of the following tables to complete your test credentials:

Merchant Account ID (MAID) |

1b3be510-a992-48aa-8af9-6ba4c368a0ac |

|---|---|

Merchant Account Name |

Wirecard CC/EFT Simu3D no CVC |

Username to access Test Account |

70000-APIDEMO-CARD |

Password to access Test Account |

ohysS0-dvfMx |

Secret Key |

33a67608-9822-43c2-acc1-faf2947b1be5 |

Mobile SDK Applicable |

No |

Merchant Account ID (MAID) |

9105bb4f-ae68-4768-9c3b-3eda968f57ea |

|---|---|

Merchant Account Name |

Wirecard CC/EFT Simu3D no CVC |

Username to access Test Account |

70000-APILUHN-CARD |

Password to access Test Account |

8mhwavKVb91T |

Secret Key |

d1efed51-4cb9-46a5-ba7b-0fdc87a66544 |

Mobile SDK Applicable |

Yes |

Merchant Account ID (MAID) |

33f6d473-3036-4ca5-acb5-8c64dac862d1 |

|---|---|

Merchant Account Name |

Wirecard CC/EFT Simu3D no CVC |

Username to access Test Account |

70000-APILUHN-CARD |

Password to access Test Account |

8mhwavKVb91T |

Secret Key |

9e0130f6-2e1e-4185-b0d5-dc69079c75cc |

Mobile SDK Applicable |

Yes |

Merchant Account ID (MAID) |

7a6dd74f-06ab-4f3f-a864-adc52687270a |

|---|---|

Merchant Account Name |

Wirecard CC/EFT Simu3D no CVC |

Username to access Test Account |

70000-APIDEMO-CARD |

Password to access Test Account |

ohysS0-dvfMx |

Secret Key |

a8c3fce6-8df7-4fd6-a1fd-62fa229c5e55 |

Mobile SDK Applicable |

No |

Merchant Account ID (MAID) |

07edc10b-d3f9-4d12-901f-0db7f4c7e75c |

|---|---|

Merchant Account Name |

Wirecard CC/EFT Simu3D no CVC |

Username to access Test Account |

70000-APILUHN-CARD |

Password to access Test Account |

8mhwavKVb91T |

Secret Key |

65f1d302-b2ac-4c52-8e31-5cc5351a258b |

Mobile SDK Applicable |

Yes |

Merchant Account ID (MAID) |

cad16b4a-abf2-450d-bcb8-1725a4cef443 |

|---|---|

Merchant Account Name |

Wirecard CC/EFT Simu3D no CVC |

Username to access Test Account |

70000-APILUHN-CARD |

Password to access Test Account |

8mhwavKVb91T |

Secret Key |

b3b131ad-ea7e-48bc-9e71-78d0c6ea579d |

Mobile SDK Applicable |

Yes |

Merchant Account ID (MAID) |

86687a11-3f9b-4f30-be54-8f22998b6177 |

|---|---|

Merchant Account Name |

Merchant-Test-Accounts |

Username to access Test Account |

70000-APILUHN-CARD |

Password to access Test Account |

8mhwavKVb91T |

Secret Key |

dce5ebea-28f0-4fce-b087-85465a138a83 |

Mobile SDK Applicable |

Yes |

Merchant Account ID (MAID) |

1d08d0ea-535e-4b1a-b50b-d1591e97b8ea |

|---|---|

Merchant Account Name |

Merchant-Test-Accounts |

Username to access Test Account |

70000-APILUHN-CARD |

Password to access Test Account |

8mhwavKVb91T |

Secret Key |

1ddab375-08da-4704-83da-36610518efcf |

Mobile SDK Applicable |

Yes |

Merchant Account ID (MAID) |

ba90c606-5d0b-45b9-9902-9b0542bba3a4 |

|---|---|

Merchant Account Name |

Merchant-Test-Accounts |

Username to access Test Account |

70000-APILUHN-CARD |

Password to access Test Account |

8mhwavKVb91T |

Secret Key |

b30bf3cc-f365-4929-89e9-d1cbde890f84 |

Mobile SDK Applicable |

Yes |

Payment Solutions

As payment solutions the Wirecard Payment Gateway provides Pay by Link via API and Invoice via Email. They both are currently only used with a Payment Page integration.

You can find

-

Pay by Link via API at Wirecard Payment Page v1 and Wirecard Payment Page v2

-

Invoice via Email at Wirecard Payment Page v1

Transaction Types

This section describes Credit Card transaction types that can be used with the Wirecard Payment Gateway. For each transaction type we provide a Credit Card specific introduction. We explain the transaction type’s availability and restrictions. We look at the conditions or preconditions required to process this transaction type.

You get the best knowledge of our transaction types when you send an XML request to our endpoint. We describe the content and structure of these requests in the section "Sending Data". For reference we also provide a response that can be expected. Where applicable we set up a flow of subsequent transaction types (e.g. authorization > capture-authorization). Refer to the complete field list for credit card transactions.

In <statuses> of the response you will find a number that represents a status code.

Update of Refund Transactions for Mastercard and Visa

-

Faster, easier refund processing.

-

No changes in the refund-request (refund-capture, refund-purchase).

-

Enhanced consumer experience: Successful refunds show up immediately in your consumers' bank statements.

We are updating refund transactions for credit card (Mastercard and Visa).

With the update, the response to a refund-request returns the authorization-code as follows:

-

If your refund-request is successful, the

authorization-codecontains a 6-digit value. -

If the issuer declines the refund-request, the

authorization-codedoes not contain a value. Please refer tostatuses.status.codefor more details.

|

In Wirecard Payment Gateways, this feature will be fully functional as of 25 May 2020 for eCommerce, POS and MOTO. The For Mastercard and Visa, the online refund mandate takes effect on 17 July 2020 for all merchants except airlines. The previously scheduled date (17 April 2020) had to be postponed due to the current COVID-19 situation. |

List of Transaction Types

Please read about details for the transaction types authorization, capture-authorization and purchase.

Reserves funds from the cardholder’s account. Typically, the limit ranges from three to thirty days to conduct a capture-authorization, depending on the acquirer and card brand. |

|

Verifies the card’s validity without leaving an authorized amount. |

|

Reserves additional funds from the cardholder’s account following an authorization. Typically, the limit ranges from three to thirty days to conduct a capture-authorization, depending on the acquirer and card brand. This transaction type is not included in default configuration. |

|

Reserves funds from the cardholder’s account. Typically, the limit ranges from three to thirty days to conduct a capture-preauthorization, depending on the acquirer and card brand. Mastercard allows up to 30 days to conduct a capture-preauthorization depending on the configuration. |

|

Takes funds from the cardholder’s account. Must follow an authorization or authorization-supplementary chain. Typically, a capture-authorization captures either part of or the full authorized amount. If you want to capture an amount higher than initially authorized, your merchant account needs to be configured accordingly (details see overcapturing). |

|

check-enrollment consists of a single request/response communication that verifies, if the card number is eligible and participates in the 3D program. |

|

check-payer-response forwards the PARes, which is a digitally signed XML document to WPG for validation. |

|

check-risk |

Checks the risk profile of the transaction information, without submitting a payment. This transaction type is not included in default configuration. |

credit |

Moves funds from the merchant account to the cardholder’s account. |

enrollment |

Enrolls a credit card for a loyalty program. |

original-credit |

Moves funds to the cardholder’s account, without referring to an eligible purchase or capture (i.e. non-referenced). This transaction type can be used for gambling and non-gambling processes. |

Takes funds from the cardholder’s account. A one-step process to conduct two transaction types: authorization and capture. |

|

referenced-authorization |

Reserves funds from the cardholder’s account. Identical to a authorization except for the fact that it refers to a previous authorization in the context of recurring transactions. See details for referencing a transaction. |

Takes funds from the cardholder’s account. Identical to a purchase except for the fact that it refers to a previous purchase in the context of recurring transactions. |

|

Moves funds to the cardholder’s account, referring to an eligible capture. |

|

Moves funds to the cardholder’s account, referring to an eligible purchase. |

|

Frees reserved funds from the cardholder’s account due to an authorization or a chain of authorization-supplementary. |

|

void-authorization-supplementary |

Voids an upwardly adjustment of an existing authorization. |

Frees reserved funds from the cardholder’s account due to a capture. |

|

void-credit |

Frees reserved funds from the cardholder’s account due to a credit. |

void-original-credit |

Frees reserved funds from the cardholder’s account due to an original-credit. |

Frees reserved funds from the cardholder’s account due to a preauthorization. |

|

Frees reserved funds from the cardholder’s account due to a purchase. |

|

void-refund |

Frees reserved funds from the cardholder’s account due to a refund. |

void-refund-capture |

Frees reserved funds from the cardholder’s account due to a refund-capture. |

Frees reserved funds from the cardholder’s account due to a refund-purchase. |

void vs. refund

It is often the case that the merchants must withdraw an online shopping process. When the consumer wants to buy a product or service online, Wirecard Payment Gateway (WPG) initiates a payment process. When the merchants withdraw this process, they can stop the process in two ways. Either with a void or a refund.

A void is only possible as long as no money transfer has been initiated. As soon as WPG has initiated the payment flow to the acquirer the merchants must return the funds to the consumer via a refund process.

Voiding a transaction requires a reference to the transaction that shall be voided.

The void transaction contains a <parent-transaction-id> that refers to

the <transaction-id> of the transaction that shall be voided.

Here is an example how to void a capture.

Refunding a transaction requires a reference to the transaction that shall be refunded.

The refund transaction contains a <parent-transaction-id> that refers

to the <transaction-id> of the transaction that shall be refunded.

Here is an example how to refund a capture.

OCT Eligibility Check

Wirecard Payment Gateway uses the transaction type authorization-only, to find out whether the card in use is eligible for original credit transactions (OCT). If you want to use this eligibility check contact merchant support for details.

authorization

authorization checks the consumer’s account for credibility and reserves a fixed amount of funds. Reservation means that Wirecard Payment Gateway informs the card holder’s issuer about the upcoming transaction. The reservation lasts from three to thirty days, depending on the acquirer and card brand. Within that time the merchants can prepare the selected products or services for shipping. Once the merchants initiate the shipping, they also initiate a capture-authorization which will transfer the authorized amount from the issuer to the acquirer.

|

authorization, preauthorization or final-authorization The functionality of an authorization as described in this section can also be configured as preauthorization or final-authorization. Which one shall be your choice, strongly depends on your business case, the acquirer and the credit card brand. Please consult your sales representative for details. |

Consumers order a dishwasher for 500 EUR online. authorization checks the consumers' account immediately and reserves 500 EUR. When the merchants start the shipping process, a capture-authorization will transfer the 500 EUR from the consumers' to the merchants' account.

authorization is generally available.

Every authorization request has a time limit depending on the card schemes. The limit refers to the period of time from sending an authorization to sending a capture-authorization. Typically, the limit ranges from three to thirty days, depending on the acquirer and card brand. It is recommended to check the card schemes for details. An authorization may be denied. Some reasons (among others) for the denial are:

-

The consumer’s credit limit is reached.

-

The card was blocked.

-

A fraud case is suspected by the issuer.

-

The card itself expired.

An authorization reserves funds on the cardholder’s account. It may be followed by a void-authorization or a capture-authorization. As an authorization merely reserves funds there is only a void possible but no refund.

A capture-authorization may be followed by either a void-capture or a refund-capture.

See details for void and refund.

We only list samples for requests and responses. Notifications follow the general structure described in General Platform Features.

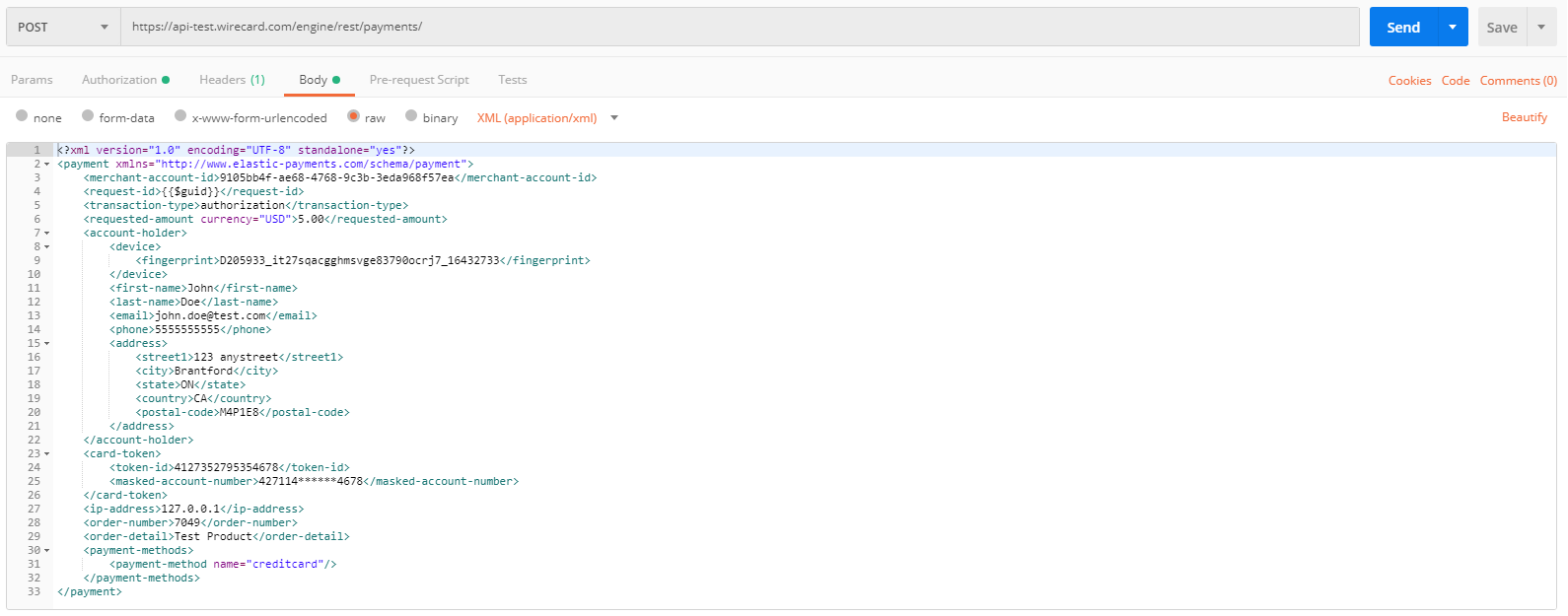

Are you using Postman to send the requests?

-

If yes, you can use the samples as provided below (Request Header and Request Sample).

-

If no, please replace

{{$guid}}with a globally unique ID in<request-id>.

In <statuses> of the response you will find a number that represents a

status code.

If the credit card is used for the first time, the authorization request will contain the clear card data. The first response immediately replaces the explicit card data with a token. The token will be used from then on.

Read how a token replaces the clear credit card data.

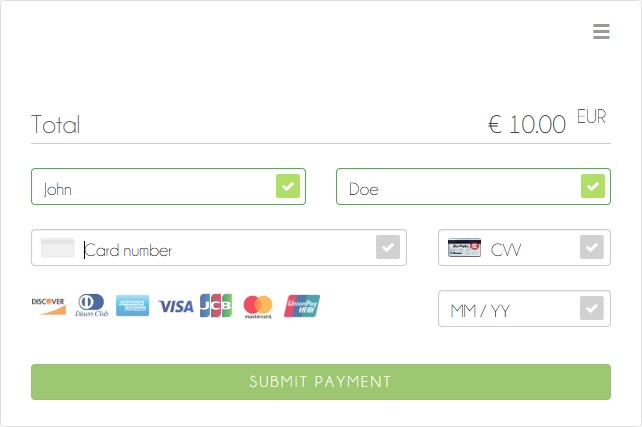

Handling clear card data requires a strong degree of PCI DSS compliance. If your PCI DSS compliance is not sufficient, you can use our Wirecard Payment Page v2.

We provide detailed descriptions of all credit card fields.

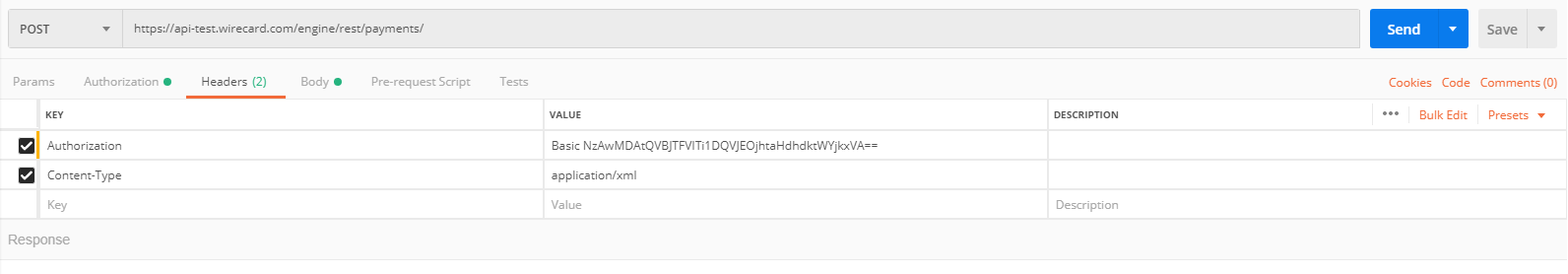

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>authorization</transaction-type>

<requested-amount currency="USD">2.50</requested-amount>

<account-holder>

<device>

<fingerprint>D205933_it27sqacgghmsvge83790ocrj7_16432733</fingerprint>

</device>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card>

<account-number>4271149787014678</account-number>

<expiration-month>12</expiration-month>

<expiration-year>2020</expiration-year>

<card-security-code>123</card-security-code>

<card-type>visa</card-type>

</card>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

</payment>We provide detailed descriptions of all credit card fields.

<card-token> data replaces the <card> data in the initial response

when using the credit card for the first time.

|

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/3d01299c-c28b-471b-976f-18249cc9d544">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>3d01299c-c28b-471b-976f-18249cc9d544</transaction-id>

<request-id>0a58d654-d0b0-40ca-bb19-f1eb4933d7cd</request-id>

<transaction-type>authorization</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-12-06T15:18:55.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<csc-code>P</csc-code>

<requested-amount currency="USD">2.50</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4127352795354678</token-id>

<masked-account-number>427114******4678</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<descriptor></descriptor>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<authorization-code>570549</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>If the credit card is already known to the merchant, the authorization request will not contain the clear card data. It will contain the token data instead.

Read how a token replaces the clear credit card data.

We provide detailed descriptions of all credit card fields.

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>authorization</transaction-type>

<requested-amount currency="USD">2.50</requested-amount>

<account-holder>

<device>

<fingerprint>D205933_it27sqacgghmsvge83790ocrj7_16432733</fingerprint>

</device>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

</payment>We provide detailed descriptions of all credit card fields.

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/0036ec58-3011-4b9f-acf3-2f6f8b3f9753">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>0036ec58-3011-4b9f-acf3-2f6f8b3f9753</transaction-id>

<request-id>3aedafa7-21c7-4620-b1b1-620e81107b6d</request-id>

<transaction-type>authorization</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-12-10T11:07:05.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">2.50</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<descriptor></descriptor>

<custom-fields>

<custom-field field-name="elastic-api.card_id" field-value="dc947622-551b-11e8-a4ae-3cfdfe334962"/>

</custom-fields>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<authorization-code>967507</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>A successful authorization response can be followed by a void-authorization (details see void).

A void-authorization request must reference a successful authorization response.

We provide detailed descriptions of all credit card fields.

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>void-authorization</transaction-type>

<parent-transaction-id>0036ec58-3011-4b9f-acf3-2f6f8b3f9753</parent-transaction-id>

<ip-address>127.0.0.1</ip-address>

</payment>We provide detailed descriptions of all credit card fields.

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/242f9dc0-04ec-450c-8246-489d32e3590e">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>242f9dc0-04ec-450c-8246-489d32e3590e</transaction-id>

<request-id>a99a9b2b-ad21-4233-bab0-d6a2c0bf3517</request-id>

<transaction-type>void-authorization</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-12-17T14:59:43.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">2.50</requested-amount>

<parent-transaction-id>878d86d2-f85e-43da-8305-4dcaa347b36f</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<custom-fields>

<custom-field field-name="elastic-api.card_id" field-value="dc947622-551b-11e8-a4ae-3cfdfe334962"/>

</custom-fields>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<parent-transaction-amount currency="USD">2.500000</parent-transaction-amount>

<authorization-code>106806</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>capture-authorization

A capture-authorization transfers an authorized amount from the consumer bank account to the acquirer (merchant’s bank account).

See authorization.

A capture-authorization must be initiated in a defined period of time after a successful authorization (details see authorization).

|

Captured Amount Typically, a capture-authorization captures either part of or the full authorized amount. |

|

Overcapturing There is also the option to capture an amount that is up to 40% higher than initially authorized. To enable this option, your merchant account needs to be configured accordingly. Please contact merchant support. |

A capture-authorization follows an authorization.

A void-capture or a refund-capture follows a capture-authorization.

See details for void and refund.

We only list samples for requests and responses. Notifications follow the general structure described in General Platform Features.

Are you using Postman to send the requests?

-

If yes, you can use the samples as provided below (Request Header and Request Sample).

-

If no, please replace

{{$guid}}with a globally unique ID in<request-id>.

In <statuses> of the response you will find a number that represents a

status code.

Request

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>authorization</transaction-type>

<requested-amount currency="USD">2.50</requested-amount>

<account-holder>

<device>

<fingerprint>D205933_it27sqacgghmsvge83790ocrj7_16432733</fingerprint>

</device>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/df92ce59-a39c-4e2d-a5d6-c3f952826acd">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>df92ce59-a39c-4e2d-a5d6-c3f952826acd</transaction-id>

<request-id>127869ec-cfce-4bc8-959a-d48866e3001d</request-id>

<transaction-type>authorization</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-12-21T10:45:58.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">2.50</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<descriptor></descriptor>

<custom-fields>

<custom-field field-name="elastic-api.card_id" field-value="dc947622-551b-11e8-a4ae-3cfdfe334962"/>

</custom-fields>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<authorization-code>570271</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>A successful authorization may be followed by a

-

void-authorization (details see void).

-

capture-authorization (details see Referencing by Transaction ID).

Request

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>capture-authorization</transaction-type>

<parent-transaction-id>df92ce59-a39c-4e2d-a5d6-c3f952826acd</parent-transaction-id>

<requested-amount currency="USD">2.50</requested-amount>

<ip-address>127.0.0.1</ip-address>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/76c1fcbf-860e-4793-88b8-b1eed6f22ab0">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>76c1fcbf-860e-4793-88b8-b1eed6f22ab0</transaction-id>

<request-id>91cdfbd6-2a54-4c5c-b29c-3b4f727586a6</request-id>

<transaction-type>capture-authorization</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-12-21T10:54:45.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">2.50</requested-amount>

<parent-transaction-id>df92ce59-a39c-4e2d-a5d6-c3f952826acd</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<custom-fields>

<custom-field field-name="elastic-api.card_id" field-value="dc947622-551b-11e8-a4ae-3cfdfe334962"/>

</custom-fields>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<parent-transaction-amount currency="USD">2.500000</parent-transaction-amount>

<authorization-code>570271</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>A successful capture-authorization may be followed by a

-

void-capture (details see void).

-

refund-capture (details see refund).

A void-capture request must reference a successful capture-authorization response.

Request

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>void-capture</transaction-type>

<parent-transaction-id>76c1fcbf-860e-4793-88b8-b1eed6f22ab0</parent-transaction-id>

<ip-address>127.0.0.1</ip-address>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/86198107-a392-4df6-92d3-6bf7a8525e71">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>86198107-a392-4df6-92d3-6bf7a8525e71</transaction-id>

<request-id>b90d6b19-bb56-4272-b794-a6cc94148c6d</request-id>

<transaction-type>void-capture</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-12-21T11:02:12.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">2.50</requested-amount>

<parent-transaction-id>76c1fcbf-860e-4793-88b8-b1eed6f22ab0</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<custom-fields>

<custom-field field-name="elastic-api.card_id" field-value="dc947622-551b-11e8-a4ae-3cfdfe334962"/>

</custom-fields>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<parent-transaction-amount currency="USD">2.500000</parent-transaction-amount>

<authorization-code>570271</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>A refund-capture request must reference a successful capture-authorization response.

Request

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>refund-capture</transaction-type>

<parent-transaction-id>dce8eb51-d520-48b5-8ae5-897297da6f10</parent-transaction-id>

<ip-address>127.0.0.1</ip-address>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/49fc219a-4821-4e0d-8c26-d9b78c4d0a7e">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>49fc219a-4821-4e0d-8c26-d9b78c4d0a7e</transaction-id>

<request-id>1db35de9-4414-4159-9852-ffef29d4a195</request-id>

<transaction-type>refund-capture</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-12-21T11:35:50.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">2.50</requested-amount>

<parent-transaction-id>dce8eb51-d520-48b5-8ae5-897297da6f10</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone>5555555555</phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4127352795354678</token-id>

<masked-account-number>427114******4678</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>7049</order-number>

<order-detail>Test Product</order-detail>

<custom-fields>

<custom-field field-name="elastic-api.card_id" field-value="d37b0e36-d712-11e5-96d8-005056a96a54"/>

</custom-fields>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<parent-transaction-amount currency="USD">2.500000</parent-transaction-amount>

<authorization-code>080119</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>purchase

purchase transfers the transaction amount without preceding reservation from the consumer directly to the merchant. With this transaction type merchants collect the money immediately while selling goods or providing a service to the consumers. Merchants use purchase in most of the cases to process POS transactions. It is also used for immediate online payments, such as software downloads.

Merchants can also perform recurring payments using the transaction type purchase. The first payment of a recurring payment process starts with the transaction type purchase which is followed by referenced-purchase transactions.

Single Payment

For POS payments, purchase is used when consumers hire a taxi and pay the taxi fare with their credit card. Or the consumers shop in a department store or grocery store and pay at the check out using their credit card.

In an online shopping process, purchase is used when consumers download software, a movie or audio files.

Recurring Payment

When consumers subscribe to a magazine or pay an insurance, they face periodically repeating payments for a certain period of time. When consumers want to pay online, merchants can arrange this type of payment with the transaction type referenced-purchase referencing a purchase transaction.

No restrictions apply to this transaction type. A purchase is generally available.

A void-purchase can stop a successfully completed purchase (merchant received a success purchase notification) as long as the funds transfer has not been initiated. The same logic applies to void a refund-purchase. That means, a void-refund-purchase can stop a refund-purchase. If merchants want to cancel the purchase after the funds transfer was initiated, they must do it with a refund-purchase.

A referenced-purchase is only possible, if there is a preceding

successful purchase transaction to refer to, which contains a

<periodic-type> and a <sequence-type>.

A purchase can be a stand-alone transaction. It may be followed by a void-purchase, a referenced-purchase or a refund-purchase. A refund-purchase may be followed by a void-refund-purchase.

See details for void and refund.

We only list samples for requests and responses. Notifications follow the general structure described in General Platform Features.

Are you using Postman to send the requests?

-

If yes, you can use the samples as provided below (Request Header and Request Sample).

-

If no, replace

{{$guid}}with a globally unique ID in<request-id>.

In <statuses> of the response you will find a number that represents a

status code.

Request

If the credit card is used for the first time, the purchase request will contain the explicit card data. The first response immediately replaces the explicit card data with a token. The token will be used from then on.

Read how a token replaces the clear credit card data.

Handling explicit card data requires a strong degree of PCI DSS compliance. If your PCI DSS compliance is not sufficient, you can use our Wirecard Payment Page v2.

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>purchase</transaction-type>

<requested-amount currency="USD">5.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone></phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card>

<account-number>4271149787014678</account-number>

<expiration-month>12</expiration-month>

<expiration-year>2020</expiration-year>

<card-type>visa</card-type>

<card-security-code>123</card-security-code>

</card>

<order-number>44152</order-number>

<order-detail>Test Product</order-detail>

<ip-address>127.0.0.1</ip-address>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

<card-token> data replaces the <card> data in the initial response

when using the credit card for the first time.

|

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/a3296ada-7d63-4131-9b5d-c6d985bb5a48">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>a3296ada-7d63-4131-9b5d-c6d985bb5a48</transaction-id>

<request-id>8fb52775-77f1-4124-aa7c-60ba672cc7cf</request-id>

<transaction-type>purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-11-26T10:11:39.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<csc-code>P</csc-code>

<requested-amount currency="USD">5.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone></phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4127352795354678</token-id>

<masked-account-number>427114******4678</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>44152</order-number>

<order-detail>Test Product</order-detail>

<descriptor></descriptor>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<authorization-code>585422</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>Request

If the credit card is already known to the merchant, a token already exists and can be used from the beginning.

Read how a token replaces the clear credit card data.

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>purchase</transaction-type>

<requested-amount currency="USD">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@example.com</email>

<phone></phone>

<address>

<street1>Example Street 1</street1>

<city>Example City</city>

<country>DE</country>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/36fc8d02-4ceb-483c-a3ff-929543452df7">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>36fc8d02-4ceb-483c-a3ff-929543452df7</transaction-id>

<request-id>c6de9490-9815-42c0-b98b-830e7067782b</request-id>

<transaction-type>purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-11-28T09:04:42.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@example.com</email>

<phone></phone>

<address>

<street1>Example Street 1</street1>

<city>Example City</city>

<country>DE</country>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<descriptor></descriptor>

<custom-fields>

<custom-field field-name="elastic-api.card_id" field-value="dc947622-551b-11e8-a4ae-3cfdfe334962"/>

</custom-fields>

<authorization-code>038588</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>A successful purchase response can be followed by

-

a void-purchase (details see void).

-

a refund-purchase (details see refund).

Recurring transactions can be referenced using

<parent-transaction-id>.

The following sample set describes a flow of recurring purchase

transactions which are connected via <parent-transaction-id>.

The Initial Transaction

The initial transaction is a purchase. It contains a <periodic>:

<periodic-type> = recurring and <sequence-type> = first.

The Recurring Transactions

There can be multiple recurring transactions. Each recurring transaction

is a referenced-purchase. It contains a <periodic>:

<periodic-type> = recurring and <sequence-type> = recurring.

The Final Transaction

The final transaction is a referenced-purchase. It contains a

<periodic>: <periodic-type> = recurring and <sequence-type> =

final.

The <parent-transaction-id>

<parent-transaction-id> of the referenced-purchase is always the

same as <transaction-id> of the initial purchase.

Workflow

purchase Request (recurring/first)

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>purchase</transaction-type>

<requested-amount currency="USD">5.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone></phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card>

<account-number>4271149787014678</account-number>

<expiration-month>12</expiration-month>

<expiration-year>2020</expiration-year>

<card-type>visa</card-type>

<card-security-code>123</card-security-code>

</card>

<order-number>44152</order-number>

<order-detail>Test Product</order-detail>

<ip-address>127.0.0.1</ip-address>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

</payment>purchase Response (recurring/first)

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/cad0c8c0-867a-451e-b820-ed65f48c0c3a">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>cad0c8c0-867a-451e-b820-ed65f48c0c3a</transaction-id>

<request-id>9ed3cebf-79f2-4055-95f3-0edbdc33752b</request-id>

<transaction-type>purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-11-28T12:30:38.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<csc-code>P</csc-code>

<requested-amount currency="USD">5.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone></phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4127352795354678</token-id>

<masked-account-number>427114******4678</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>44152</order-number>

<order-detail>Test Product</order-detail>

<descriptor></descriptor>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<authorization-code>871877</authorization-code>

<api-id>elastic-api</api-id>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>first</sequence-type>

</periodic>

<provider-account-id>70001</provider-account-id>

</payment>referenced-purchase Request (recurring/recurring)

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>referenced-purchase</transaction-type>

<parent-transaction-id>cad0c8c0-867a-451e-b820-ed65f48c0c3a</parent-transaction-id>

<requested-amount currency="USD">5.01</requested-amount>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

</payment>referenced-purchase Response (recurring/recurring)

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/e3baaaf8-3417-4650-998c-058557e5847e">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>e3baaaf8-3417-4650-998c-058557e5847e</transaction-id>

<request-id>1f38bbc0-247a-46c2-b4b5-5b669747c93e</request-id>

<transaction-type>referenced-purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2019-01-11T07:33:19.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">5.01</requested-amount>

<parent-transaction-id>cad0c8c0-867a-451e-b820-ed65f48c0c3a</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone></phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4127352795354678</token-id>

<masked-account-number>427114******4678</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>44152</order-number>

<order-detail>Test Product</order-detail>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<parent-transaction-amount currency="USD">5.010000</parent-transaction-amount>

<authorization-code>384949</authorization-code>

<api-id>elastic-api</api-id>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>recurring</sequence-type>

</periodic>

<provider-account-id>70001</provider-account-id>

</payment>referenced-purchase Request (recurring/final)

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>referenced-purchase</transaction-type>

<parent-transaction-id>cad0c8c0-867a-451e-b820-ed65f48c0c3a</parent-transaction-id>

<requested-amount currency="USD">5.01</requested-amount>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>final</sequence-type>

</periodic>

</payment>referenced-purchase Response (recurring/final)

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/d9736b05-efe1-46ec-ac27-9e842d5a0785">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>d9736b05-efe1-46ec-ac27-9e842d5a0785</transaction-id>

<request-id>0e0b9e60-8c84-42df-ae6e-cf8dfb7f907f</request-id>

<transaction-type>referenced-purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2019-01-11T07:39:22.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">5.01</requested-amount>

<parent-transaction-id>cad0c8c0-867a-451e-b820-ed65f48c0c3a</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone></phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4127352795354678</token-id>

<masked-account-number>427114******4678</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>44152</order-number>

<order-detail>Test Product</order-detail>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<parent-transaction-amount currency="USD">5.010000</parent-transaction-amount>

<authorization-code>167472</authorization-code>

<api-id>elastic-api</api-id>

<periodic>

<periodic-type>recurring</periodic-type>

<sequence-type>final</sequence-type>

</periodic>

<provider-account-id>70001</provider-account-id>

</payment>A void-purchase must reference a successful purchase response.

| A void-purchase shall be used only, if the payment was processed in an online shop and not at a POS. |

We only list field descriptions for requests and responses. Notifications follow the general structure described in General Platform Features.

Request

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>void-purchase</transaction-type>

<parent-transaction-id>36fc8d02-4ceb-483c-a3ff-929543452df7</parent-transaction-id>

<ip-address>127.0.0.1</ip-address>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/baf93d19-15ec-11e5-87be-00163e5411b5">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>baf93d19-15ec-11e5-87be-00163e5411b5</transaction-id>

<request-id>{{$guid}}</request-id>

<transaction-type>void-purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-06-18T19:03:41.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information" provider-transaction-id="C847532143465422040880"/>

</statuses>

<requested-amount currency="USD">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone></phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4119529611183494</token-id>

<masked-account-number>414720******3494</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<order-number>5114</order-number>

<order-detail>Test Product</order-detail>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<authorization-code>940987</authorization-code>

<api-id>elastic-api</api-id>

</payment>Merchants use a refund-purchase to refund a purchase or parts of it after the funds transfer was initiated.

A refund-purchase must reference a successful purchase response.

We only list field descriptions for requests and responses. Notifications follow the general structure described in General Platform Features.

Request

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>refund-purchase</transaction-type>

<parent-transaction-id>36fc8d02-4ceb-483c-a3ff-929543452df7</parent-transaction-id>

<ip-address>127.0.0.1</ip-address>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/01a62281-15e4-11e5-87be-00163e5411b5">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>01a62281-15e4-11e5-87be-00163e5411b5</transaction-id>

<request-id>${response}</request-id>

<transaction-type>refund-purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2015-06-18T18:01:14.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information" provider-transaction-id="C851766143465047366859"/>

</statuses>

<requested-amount currency="USD">1.01</requested-amount>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@wirecard.com</email>

<phone></phone>

<address>

<street1>123 anystreet</street1>

<city>Brantford</city>

<state>ON</state>

<country>CA</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4266575172147814</token-id>

<masked-account-number>413496******7814</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<authorization-code>136208</authorization-code>

<api-id>elastic-api</api-id>

</payment>A successful refund-purchase response can be followed by a void-refund-purchase (details see void).

With this transaction type you can void a successful refund-purchase until the funds transfer has been triggered.

Request

Fields

We provide detailed descriptions of all credit card fields.

Sample

Authorization: Basic NzAwMDAtQVBJTFVITi1DQVJEOjhtaHdhdktWYjkxVA==

Content-Type: application/xml<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment">

<merchant-account-id>9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<request-id>{{$guid}}</request-id>

<transaction-type>void-refund-purchase</transaction-type>

<parent-transaction-id>01a62281-15e4-11e5-87be-00163e5411b5</parent-transaction-id>

<ip-address>127.0.0.1</ip-address>

</payment>Response

Fields

We provide detailed descriptions of all credit card fields.

Sample

<?xml version="1.0" encoding="UTF-8" standalone="yes"?>

<payment xmlns="http://www.elastic-payments.com/schema/payment" xmlns:ns2="http://www.elastic-payments.com/schema/epa/transaction" self="https://api-test.wirecard.com:443/engine/rest/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea/payments/9ff6eb1f-d729-4b93-bad2-75300abd3168">

<merchant-account-id ref="https://api-test.wirecard.com:443/engine/rest/config/merchants/9105bb4f-ae68-4768-9c3b-3eda968f57ea">9105bb4f-ae68-4768-9c3b-3eda968f57ea</merchant-account-id>

<transaction-id>9ff6eb1f-d729-4b93-bad2-75300abd3168</transaction-id>

<request-id>5cffdb9b-91ce-4ddb-945e-961a025e6582</request-id>

<transaction-type>void-refund-purchase</transaction-type>

<transaction-state>success</transaction-state>

<completion-time-stamp>2018-12-27T12:09:51.000Z</completion-time-stamp>

<statuses>

<status code="201.0000" description="3d-acquirer:The resource was successfully created." severity="information"/>

</statuses>

<requested-amount currency="USD">1.01</requested-amount>

<parent-transaction-id>87fffba5-0824-4bba-843f-ed7574ae2022</parent-transaction-id>

<account-holder>

<first-name>John</first-name>

<last-name>Doe</last-name>

<email>john.doe@example.com</email>

<phone>5555555555</phone>

<address>

<street1>Example Street 1</street1>

<city>Example City</city>

<state>ON</state>

<country>DE</country>

<postal-code>M4P1E8</postal-code>

</address>

</account-holder>

<card-token>

<token-id>4845276539271999</token-id>

<masked-account-number>456396******1999</masked-account-number>

</card-token>

<ip-address>127.0.0.1</ip-address>

<custom-fields>

<custom-field field-name="elastic-api.card_id" field-value="dc947622-551b-11e8-a4ae-3cfdfe334962"/>

</custom-fields>

<payment-methods>

<payment-method name="creditcard"/>

</payment-methods>

<parent-transaction-amount currency="USD">1.010000</parent-transaction-amount>

<authorization-code>550452</authorization-code>

<api-id>elastic-api</api-id>

<provider-account-id>70001</provider-account-id>

</payment>Fields

This is the general field reference for credit card transactions.

-

Format: XML

-

POST requests and responses

We provide the request and the response fields in two separate sections:

The fields are ordered hierarchically and in separate tables. payment is the top parent element and all fields that are part of payment are listed in the payment table.

Some fields listed in this table are complex type fields, e.g. payment.account-holder. Complex type fields are parents to further fields. We offer separate field tables for all parent elements and their respective fields.

| The tables are sorted alphabetically. Use Ctrl + F if you are looking for a specific field. |

For example, payment.account-holder is a parent of address. Click on the link in the table to view the fields contained in a complex type field.

Field Definitions

Each field table contains the following columns:

| Field definitions may vary by transaction type. Deviations from standard field definitions are given with the respective transaction type. |

XML Elements

Click the X in the respective column for request and response fields.

Please refer to our XSD for the structural relationship between these fields.

| Field | Request | Response |

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

||

|

Request

payment.You can find additional payment fields in the Response > payment section.

| Field | M/O | Data Type | Size | Description |

|---|---|---|---|---|

|

M/O |

String |

36 |

Unique identifier assigned to each merchant account.

Mandatory unless |

|

M/O |

String |

36 |

Used to resolve the merchant account based on a number of resolving rules. Mandatory unless |

|

M |

String |

150 |

The identification number of the request. It must be unique for each request. |

|

M |

Decimal |

18.3 |

The total amount that is requested in a transaction. In the case of a refund, this is what you request. In the case of a chargeback, this is the amount that is being contested. |

|

M |

String |

3 |

The currency of the requested transaction amount. |

|

M |

String |

30 |

Determines a transaction’s behavior during transaction processing and merchant settlement, e.g.

|

|

O |

String |

64 |

The descriptor is the text representing an order on the consumer’s bank statement issued by their credit card company. |

|

O |

String |

65535 |

Merchant side order details. |

|

O |

String |

32 |

The order number which you can provide. |

|

M/O |

String |

50 |

The ID of the consumer. |

|

M/O |

String |

36 |

Unique identifier for a preceding transaction. This is mandatory to assign a transaction to a previous one, e.g. to capture a preceding authorization. |

|

O |

String |

36 |

A unique ID assigned to a group of related transactions. For example, an authorization, capture, and refund will all share the same |

|

O |

String |

36 |

The

|

|

O |

String |

45 |

The global (internet) IP address of the consumer’s device. |

|

O |

Enumeration |

7 |

A transfer type of non-gambling Original Credit Transaction (OCT).

|

|

O |

String |

256 |

The URL to which the consumer is redirected during payment processing. This is normally a page on your website. Enter a value in the request if you want to send your consumer to a different page than defined in your integration. |

|

O |

String |

256 |

The URL to which the consumer is redirected after a successful payment. This is normally a success confirmation page on your website. Enter a value in the request if you want to send your consumer to a different page than defined in your integration. |

|

O |

String |

256 |

The URL to which the consumer is redirected after the payment has been canceled. This is normally a page on your website. Enter a value in the request if you want to send your consumer to a different page than defined in your integration. |

|

O |

String |

256 |

The URL to which the consumer is redirected after an unsuccessful payment. This is normally a page on your website notifying the consumer of a failed payment, often suggesting the option to try another payment method. Enter a value in the request if you want to send your consumer to a different page than defined in your integration. |

|

O |

String |

6 |

Code of the language the payment page is rendered in. Typically used in conjunction with Hosted Payment Page. |

|

O |

Enumeration |

n/a |

Channel through which the account holder information was collected.

|

|

O |

Enumeration |

2 |

|

|

O |

Enumeration |

Accepted values:

|

|

account-holder.account-holder is a child of payment.

With the account-holder you can provide detailed information about the consumer.

The cardinality of the account-holder fields can vary, depending on the use case. You can find the details below in the description of the individual fields.

|

| Field | M/O | Data Type | Size | Description |

|---|---|---|---|---|

|

O |

Date |

Consumer’s birth date. |

|

|

M/O |

String |

156 |

Consumer’s email address as given in your shop. |

|

M/O |

String |

32 |

First name of the consumer. |

|

M/O |

String |

32 |

Last name of the consumer. |

|

O |

Enumeration |

1 |

Consumer’s gender.

|

|

O |

String |

64 |

Consumer identifier in your shop. Requests that contain payment information from the same consumer in the same shop must contain the same string. |

|

O |

String |

18 |

Mobile phone number provided by the consumer. |

|

M/O |

String |

18 |

Phone number provided by the consumer. |

|

O |

String |

18 |